Salvage And Rebuilt Title Cars

There is a lot of confusion about Buying Cars with Branded Titles or cars with Salvage and/or Rebuilt Titles.

So I thought it was about time we answered some of your most common questions about these types of vehicles and whether buying one is wise.

Related Articles to Read:

Table of Contents

Buying a Salvage Title Car

What Is A Salvage Title?

A Salvage Title is a title assigned to a vehicle that an insurance company wrote off because it experienced damage that would cost more to repair than the vehicle is worth. Most people commonly refer to this type of vehicle as being:

- Totaled

- Totaled Out

- Total Loss

The important thing to note about a salvage vehicle is that you can’t simply get in it and drive it legally anyway.

Also Read: Do stolen cars get a salvage title?

A car with a salvage title is considered to be unsafe for the roadways and only when a salvaged vehicle has been repaired, checked by the State or DMV authority, and given a “Rebuilt Title” can you then register and drive the vehicle.

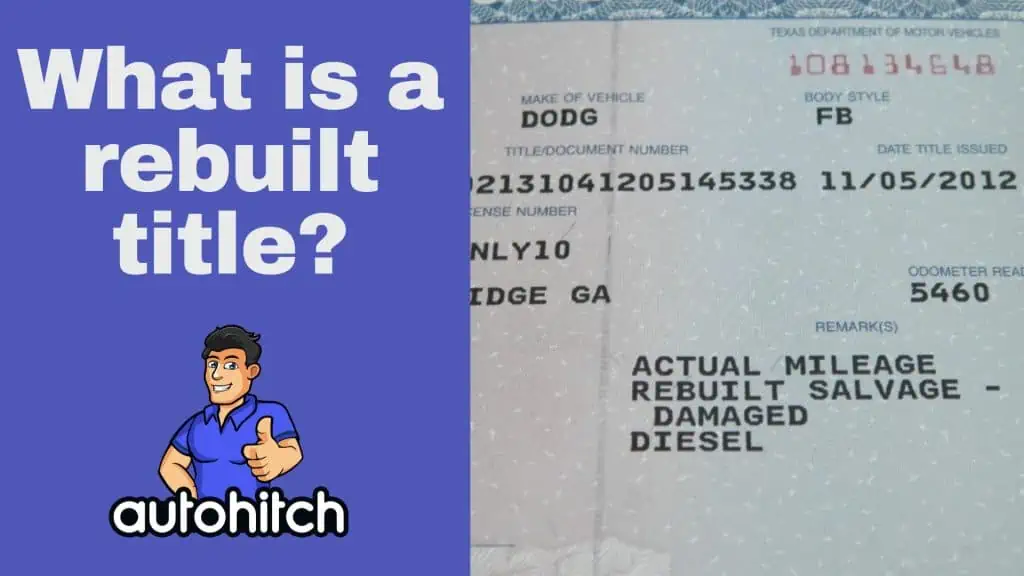

What Is A Rebuilt Title?

A Rebuilt title is a title that has been issued to a vehicle that was previously assigned a Salvage Title, but only after that vehicle has been repaired and inspected, typically by the State.

It is important to note that the inspections performed by the state before issuing a Rebuilt title are not pre-purchase inspections or the type of vehicle inspection you might order before buying a used car. These inspections are simply to verify that work was done and that all of the paperwork is in order.

What does a salvage title look like

A Salvage title will look different from state to state, but generally, you will see Red Text or something that looks like a Red Stamp somewhere on the front of the title located above the signature area.

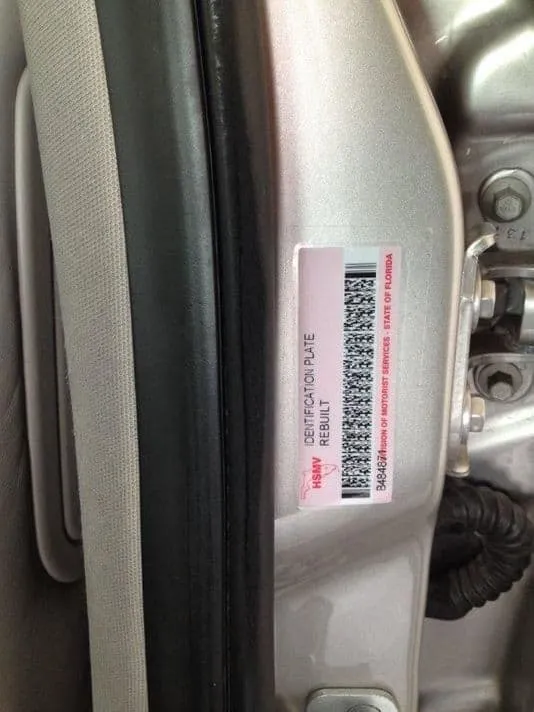

If you are like most people, however, you are probably going to see the vehicle long before the title and would rather not waste your time.

To the right of the photo below, you will see a picture of a sticker that is inside of a door jam. This decal is probably the easiest way to tell if a car has a salvage and/or rebuilt title.

This sticker indicates a “Rebuilt Title” and must be placed here by law when the rebuilt title has been granted on a salvaged car.

- Remember: A Car can be Salvaged but not yet Rebuilt, in which case the car would not be street-legal. So, you might not see this decal on a salvage car that someone is trying to pass off as legit and would have to revert to your vehicle history report or the title.

Can A Salvage Title Have A Lien?

Yes, since it is possible to finance a car with a salvage title, it is possible that you could encounter a salvage title that has a lien.

What Is A Branded Title?

A Branded Title is essentially the overall permanent designation (Salvage or Rebuilt) placed on a car title that indicates the vehicle was written off because of serious damage or other mitigating circumstances, such as:

- Fire

- Flood

- Collision

- Being Sold For Scrap

A car receiving the designation of branding is almost always mandatory in most states once an insurance company (Or the owner) has written off a vehicle or declared it an official “Total Loss.”

Aside from all the legal jargon, a branded title is just another name for a salvage or rebuilt title.

What Makes A Car A Salvage Car?

If you are in the market for a deal on a used car, you will probably come across a really good price on a salvage title/rebuilt title car and wonder: What made that car Salvage in the first place?

So, let’s list several ways that a car can become salvage because not all have to do with crazy amounts of damage:

1. Natural Disaster

These types of salvage titles come from floods, hurricanes, tornadoes, fires, etc.

You need to keep an eye out for flood-damaged vehicles because, once cleaned, they are very hard to spot to the untrained eye. A lot of people make some pretty good money scamming the public, selling these cars as either undamaged or simply lying about the water damage and claiming there were other reasons for the branded title.

2. Aftermarket Parts

No, you won’t get a salvage title for changing to a sporty air filter, but if you significantly modify the engine or other major components, you very well could attract the branding because you have now changed the car from the way it was designed to function and this can be seen as a safety risk.

Don’t get mad at me, I’m just the messenger!

3. Kit Cars

Kit Cars are the types of cars where someone makes a Honda look like a Ferrari. Unfortunately, these vehicles have received so many modifications that they in no way, shape or form resemble what they were intended to be when they were manufactured.

Again, because of so many unknowns, the state and insurance companies will consider this car a higher risk to insure and have on the roads.

4. Restored Classic And Antique Cars

Again we run into a similar problem as #2 and #3, but in this case, you may have a vehicle that is so rare it’s hard to restore with factory parts, and that means custom parts fabricated outside of the scope of the original manufacturer.

-This isn’t very common by any means, and a lot of it depends on your state’s laws. It will also help if the vehicle still has the original title with it.

If it does not, then a visit to the DMV to get paperwork is usually where the scrutiny can take place

5. The Car Was Stolen

Simply having your car stolen won’t trigger a salvage or branded title, but if the vehicle isn’t recovered before your insurance company writes it off, then it will have been considered a total loss and receive a branded (Salvage) Title.

Important:

The stolen car salvage title is the most common type of salvage that a scam artist or fraudster will try to feed you to hide a flooded car or a car with some other more “Intimidating” type of damage. Because of this, it is imperative that you verify the reason for the branded title because the title WILL NOT TELL YOU why the branding was placed.

To verify if a vehicle was stolen, head over to the NICB and check the vehicle’s vin absolutely free!

6. Car Accident

I listed the serious car accident last because it’s the most obvious; however, it is still a reason and the main reason cars will be branded as salvage, so it definitely deserves a spot on the list.

If your car has a salvage title and a recall, check out our article: Does a Salvage Title Void Recalls?

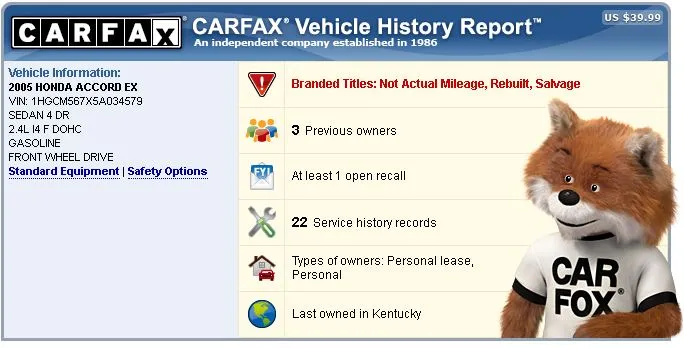

Get A Salvage Title Check

If you suspect that a vehicle you are looking to buy, or may have already purchased, has been branded as a Salvage or Rebuilt Title car, do not hesitate for a second to check out the vehicle’s history. You can use one of a number of sources to check on a salvage title, but I recommend these:

The NICB (National Insurance Crime Bureau) is unknown to regular everyday car buyers, but it’s a hell of a resource if you need to verify whether a car was ever reported as stolen and not recovered or reported as a Salvage Vehicle.

Now it is important to note that the NICB can only account for the insurance companies that are NICB Members, which are still a great majority, so it’s not 100%. That being said, Carfax or Autocheck can’t account for every insurance carrier reporting either, but at least this tool is Completely Free.

How To Turn A Salvage Title Into A Clean Title

Well, You can’t change a branded title into a clean title (Ever).

When a vehicle’s title has been salvaged, it has been “Branded” and will never again be considered a “Clean Title”.

The only option that is available to you is to have a salvage title declared “Rebuilt” or “Reconditioned” by your state DMV.

Steps To Clearing Your Title From Salvage

Depending on where you enter the process, you may end up having a step or two more/less before you eventually clear a salvage title, but these are essentially the steps in order from the day you buy the car:

1. Purchase A Vehicle With A Salvage title

Remember, this vehicle cannot be registered or driven. Also, note that not all states allow individuals to purchase salvage titles cars, so your particular state may require a certain license.

2. Make Repairs To The Vehicle

The DMV is going to have to sign off on the work, so it would be best to have a licensed and certified mechanic do the work so you don’t encounter any problems here.

It will also be a good idea to make sure that every part of the repair process is documented with receipts and notations of what work was done; pictures and video wouldn’t hurt here either!

3. Get The DMV Inspection

Most people think this is like a dealer’s inspection of a car before they make a purchase, but it is very far from being that thorough.

All the DMV is looking for is if the main problem related to the vehicle being totaled in the first place was fixed and documentable (Which is where your certified mechanic and receipts come in).

*The inspection is typically not performed by the same people that work the counter to give you a license/tag.

4. Paperwork And Title

If the DMV clears your repairs, you will get a paper authorizing you to get a Rebuilt or Reconditioned title, in which you have a few more forms and fees to fork over, but aside from that, the work is done, and you will now be able to drive the car.

How Much Does A Rebuilt Title Change The Value Of A Car?

A good gauge of the amount of value that a car can lose after getting a rebuilt title will be between the 20%-50% range.

I know that can be a lot of money one way or the other, but you have to remember the age and type of vehicle are going to play a role. If a one-year-old SUV it totaled then receives a rebuilt title, it’s going to retain more value than a 5-year-old Honda Civic.

Is A Rebuilt Title A Bad Thing?

The question of whether a rebuilt title is bad comes down to answering the same question you must ask yourself on any car purchase: What’s this worth “To Me”.

When I sold cars myself, there were several occasions in which I actually had obtained cars that were Salvaged and then rebuilt.

The only time I would ever buy these vehicles is if they were late model cars (Not that old) and if they had been repaired correctly, something I could assess with a pre-purchase inspection.

The reason I bought these cars was simple:

They are in very high demand! Think about it- You can get a car or truck that’s only a few years old and at a price that would be around 30%-40% cheaper (On AVG). Yeah, there is definitely a market for that.

The Bottom Line:

There are two times, in my opinion, that a rebuilt title is bad:

- If you owned the vehicle before the damage

- If the repairs were made incorrectly

Should You Buy A Car That Has A Salvage Title

Buying a car that has a Salvage title can have its perks and it’s cons, but generally, I do not recommend to the average person that they should ever get involved with a vehicle that has a salvage title. Salvage title car buying should be limited to individuals with extensive knowledge of vehicles and the law, and this is to avoid financial loss and for your own personal safety should you end up with a car that has major problems.

That being said, don’t let anyone decide what is right for you, including me, and to help you make the most informed decision, let’s discuss some of the pros and cons of buying a car with a salvage title below.

Salvage Title Car Buying Cons:

- What is the actual damage to the vehicle– When an insurance company declares a vehicle a total loss, that’s the extent of their inspections and descriptions.

- They don’t pour through a car to determine how much of a total loss it is, they want to get it off the books.

- So, it will be on you to determine what is actually right and wrong with the car.

- Your Safety or the Safety of your family: The people that buy and sell salvaged cars operate on tight margins, and if they end up with a car that has more issues than they planned, they can and will skip repairs to avoid losing money.

- Which repairs they passed on, if any, will be up to you to discover!

- The industry with a lot of Fraud- Again, not all, but many of the people selling salvage cars are a little dodgy, and it’s going to be hard for you to come back on someone claiming you didn’t there was a problem with a car that had a salvage title (Obviously it’s not perfect).

- A lot of these purchases are “As Is,” and as far as most (If not all) states are concerned, the responsibility for finding problems with a car before purchase is on the buyer, not the seller. So, no one is going to be there to back you up unless you have some really hard evidence of Fraud.

- Problems getting insured: Most insurance companies either won’t cover cars with a salvage title or offer only very limited coverages.

- Problem getting financing for salvage cars: Most banks will also not issue loans or financing for salvage title cars because they won’t hold enough value as collateral should you default on a loan or get into another accident.

- Rapidly depreciating asset: A car is a depreciating asset, which means that unlike a home a car (Almost always) goes down in value. Add to it a car that has been totaled, and you probably won’t have a car that is worth much of anything should you ever have to sell it yourself or even trade it in.

Salvage Title Car Loans – Where To Get Them

When buying any type of vehicle, one of the most common questions is around financing, but this is never more true than it is with salvage vehicles because no one knows where to get a salvage title car loan.

Heck, most people don’t even know they exist, and that’s because a lot of the common financial institutions that do auto loans don’t supply them.

Lenders Offering Salvage Title Loans

So, where can you find some banks or lenders that finance salvage title car loans? I have compiled a list of several that you can try in the following article: Banks That Finance Rebuilt & Salvage Titles