Filing for bankruptcy is scary, especially if you’re worried about losing your vehicle.

The good news is that in most cases, you can keep your car when declaring bankruptcy by understanding and utilizing your state’s exemption laws and the strategies available in Chapter 7 and Chapter 13 bankruptcy filings.

Table of Contents

Relevant Articles To Read:

- Bankruptcy vs. Car Repossession: Which Is Worse

- Voluntary Repossession

- Give Back Car – Avoid Repossession

- The Complete Guide to Car Repossession

- How Soon After Bankruptcy Can I Buy a New Car?

- What If I Buy a Car While Under Chapter 13 Without Trustee Permission?

- Chapter 13 Dismissed How Long Before Repo

What Determines If You Keep Your Car in Bankruptcy?

Whether you can keep your car when filing for bankruptcy depends on several key factors:

- Your state’s vehicle exemption laws

- The current market value of your car

- The amount you still owe on your car loan (if applicable)

- The type of bankruptcy you file (Chapter 7 or 13)

- Your ability to continue making loan payments

Understanding these elements and planning accordingly with your bankruptcy attorney can often allow you to retain possession of your vehicle.

Checking Your State’s Exemption Limits

Every state has exemption laws that allow you to protect, or exempt, certain assets like your car when filing for bankruptcy. The exempted amount varies widely, from $1,000 in states like Florida to unlimited exemptions in Texas.

Be sure to verify your state’s specific vehicle exemption limit.

As long as your car’s value falls under that threshold, you have a strong chance of keeping your car.

For example, if your state’s limit is $5,000 and your car’s current value is $4,000, you can likely exempt it entirely. Every state also has additional “wildcard” exemptions you can use to cover any value over the vehicle exemption.

How Car Value and Loans Impact Your Options

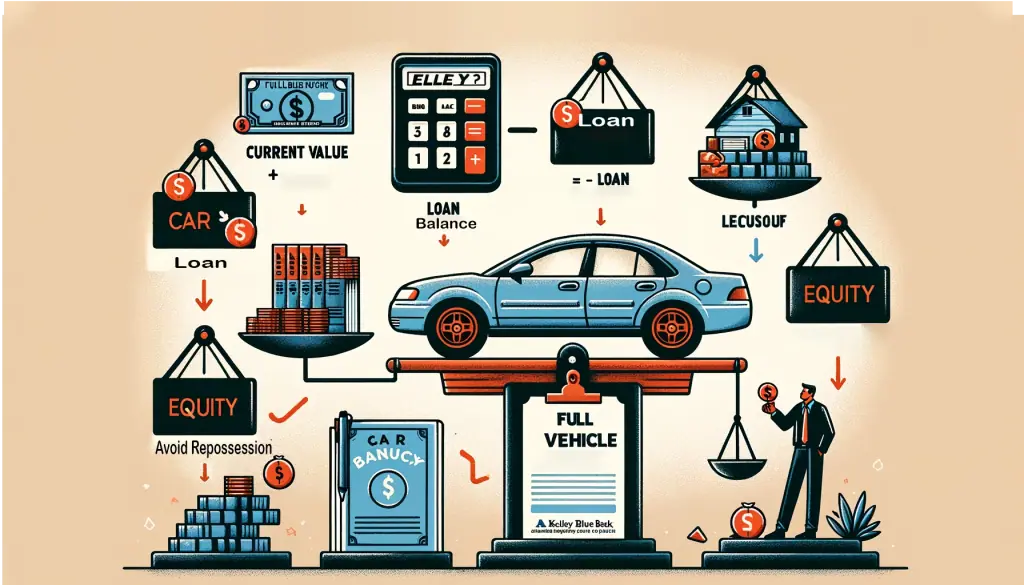

To determine what bankruptcy strategies give you the best odds of retaining your car, you need to calculate your vehicle’s equity.

Equity equals the car’s current value minus any loan amount you still owe.

Value depreciates quickly, so use accurate sources like Kelley Blue Book to assess your car’s real worth.

- If you have no car loan, the equity is the full vehicle value.

- If your loan balance is less than value, you have positive equity.

- If loan exceeds value, you have zero or negative equity.

Positive equity gives you more flexibility in bankruptcy. If loan payments remain, catching up on delinquencies can help avoid repossession.

Keeping Your Car in Chapter 7 Bankruptcy

Under a Chapter 7 bankruptcy, some assets may get liquidated to pay debts. But you can exempt certain property, often including all or most of your car. Here’s how Chapter 7 works to retain vehicles:

Exempt car value using state vehicle + wildcard exemptions

- As long as total exemptions cover equity, you keep car

- Can buy back nonexempt portion from trustee

Catch up/stay current on car loan payments

- Lender can repossess if payments lapse

- Can reaffirm loan or redeem car for value

Consider surrender if underwater on loan

- Discharges deficiency balance

- Frees you from burdensome payments

Talk to your bankruptcy lawyer about the specifics of your situation to create a Chapter 7 strategy for keeping your car.

Keeping Your Car in Chapter 13 Bankruptcy

Chapter 13 bankruptcy operates via a 3-5 year debt repayment plan. Your assets aren’t liquidated, and through the repayment plan, you can often retain possession of your vehicle.

Here’s how to keep your car using Chapter 13 protections:

Catch up on delinquent auto loan payments

- Repayment plan allows you time to become current

Adjust loan terms, interest rates

- Court can force lender concessions to help you

Reduce loan balance to car value

- “Cram down” option if owned over 2.5 years

As with Chapter 7, you can also voluntarily surrender your vehicle if the payments or car condition becomes unmanageable.

Discuss using Chapter 13 bankruptcy with an attorney to understand if it offers you the best chance at debt relief while retaining your car.

Key Steps to Protect Your Vehicle in Bankruptcy

Regardless of which bankruptcy option you pursue, here are vital steps to give yourself the highest probability of keeping your car:

- Review your state’s exemption limit on motor vehicles

- Accurately assess your car’s current resale value

- Determine the equity by factoring in any auto loan balance

- Continue making monthly car payments if financially viable

- Compare Chapter 7 and 13 processes and protections

- Consult an experienced bankruptcy attorney

What If My Car Gets Repossessed Before or After Filing?

Some lenders quickly move to repossess vehicles when you miss payments or declare bankruptcy. But even if your car gets repossessed before or during bankruptcy, you may still recover it:

- Bankruptcy halts repossession proceedings

- You can ask court to reverse improper repossessions

- If lender hasn’t sold car post-bankruptcy, you may redeem

This complex situation needs guidance from a legal professional. Don’t hesitate to seek advice.

Conclusion: A Bankruptcy Attorney Can Help Save Your Car

Losing your vehicle may feel imminent when facing mounting debts and bankruptcy. But knowledgeable legal help combined with your state’s exemption limits can facilitate keeping your car in many cases.

Let an attorney assess your unique financial position and determine what combination of exemptions, loan adjustments, surrender, redemption, or reaffirmation might apply. With preparation and understanding the law, your bankruptcy filing doesn’t have to mean losing your essential transportation.

Sources and References:

- https://www.borowitzclark.com/what-will-happen-my-car-if-i-file-bankruptcy-california/

- https://www.ny-bankruptcy.com/can-i-keep-my-car-under-chapter-7-bankruptcy

- https://www.investopedia.com/how-to-file-bankruptcy-on-a-car-loan-7557611

- https://ccadvising.com/articles/bankruptcy-keeping-your-house-and-car

- https://www.nolo.com/legal-encyclopedia/should-i-keep-my-car-chapter-13.html