Losing your vehicle to repossession can be stressful and financially devastating.

This guide covers most everything you need to know about the repossession process, with a large selection of more specific topics related to repossession below:

Table of Contents

Relevant Articles to Read:

- 25 Things Repo Man Can or Can’t Do To Get Your Car

- When Does Westlake Financial Repossess Your Car?

- The Pros and Cons of Buying a Repossessed Car

- What Happens If You Hide Your Car From Repossession

- Can A Repo Man Move Another Car To Get to Yours

- Bankruptcy vs. Car Repossession: Which Is Worse

- How to Get Your Car Back After Repossession

- Car Repossession Laws By State

- How Much Are Repossession Fees

- Can I file For Bankruptcy And Keep My Car

- What Time Do Repo Men Usually Come

- Can a Repo Man Enter a Gated Community

- How Long Does a Voluntary Repo Stay on Your Credit

- How to Get a Repo Off Your Credit Report

What is Car Repossession?

Car repossession, often shortened to “repo,” is when a lender or leasing company forcibly takes back a car due to missed payments or other contract breaches.

The lender hires a repossession company to seize the vehicle on their behalf. This usually occurs once payments are 90+ days late, though timing varies.

Key Takeaways

- Repossession lets lenders recoup losses from unpaid car loans

- It typically happens after 90+ days of missed payments

- A repo company will seize and tow the vehicle to storage or auction

Car Repossession Statistics United States

| Statistic | Value |

|---|---|

| 2022 Repossessions | 1.2 million vehicles |

| 2023 Projected Repossessions | 1.5 million vehicles |

| Subprime Delinquencies (60+ days) | 6.11% – 30-year high |

| Repo Bounties Offered | $500 per vehicle |

| New Car Average Price | $48,000 |

| Subprime Loan Interest Rates | 18.5% average |

Key Takeaways

- Repossessions will hit 1.5 million vehicles in 2023 after rebounding from pandemic lows

- Subprime delinquencies signal rising distress among higher-risk borrowers

- Spiking new car prices stretch budget for many; loan rates compound issues

- Lenders now offer bounties to accelerate seizures amid projections

In summary, while still recovering from COVID-19 declines, auto repossessions and seriously delinquent loans are rapidly increasing. Expert projections suggest this trend will gain steam into 2023 and 2024 as affordability deteriorates, especially for subprime buyers. Lenders appear to be preparing for a significant wave of defaults and seizures in coming years.

The Repossession Process

The repossession process itself looks like this:

- Default on Loan Terms – The process begins when you miss too many payments, lack proper insurance, or otherwise break loan rules.

- Vehicle Disabling – Modern cars may have remote “kill switches” to disable them for easy pickup.

- Seizure – A tow truck will remove the repossessed car from your property and tow it away.

- Sale – The lender sells the car at dealer auction or sometimes privately to recoup losses.

- Potential Deficiency – If sale proceeds don’t cover your loan balance, you may owe the difference.

Repo Process Overview

| Stage | Description |

|---|---|

| 1. Default on Loan | Missing payments or breaking contract terms |

| 2. Vehicle Disabling | Remote kill switches disable car startup |

| 3. Seizure | Tow truck removes car from private property |

| 4. Sale at Auction | Car sold to cover lender losses |

| 5. Potential Deficiency | Further debts if sale doesn’t cover balance |

How Long Before a Car Is Repossessed?

Generally, a lender will not start the repossession process until you have missed three payments, but they can start as soon as 1-2 missed payments if they feel you have no intention of making payments or making it impossible to get the car back.

Repossession Laws & Regulations

Repossession laws vary significantly by state. However, some common themes include:

- No Required Grace Period – Cars can potentially be seized after just one missed payment.

- No Advance Notice Mandated – Lenders aren’t required to notify consumers before repossessing vehicles in most states.

- Private Property Allowed – Repo agents can enter private property like driveways without a court order in most states.

- Breach of Peace Restricted – Violence/force during seizure is illegal. Removing vehicles from closed garages also violates breach of peace doctrines.

Military service members receive added protections under the Servicemembers Civil Relief Act (SCRA), requiring court orders before any repossession action.

Key Takeaways

- One missed payment can trigger repossession

- No notice mandated before seizure in most states

- Entering private property is typically allowed

- SCRA adds protections for active military

Your Rights After your Car Has Been Repossessed

Consumers do retain certain rights around the repossession process:

Personal Property Retrieval

Any personal items left inside repossessed vehicles must be returned to you. This includes cell phones, purses, work equipment, etc.

The lender can’t charge you storage fees or demand payments to get personal effects back. Make sure to inventory anything of value left in the car.

Potential Buyback Opportunities

Depending on local laws, you may be able to buy back repossessed vehicles before they go to auction by:

- Paying the tow/storage fees

- Reinstating the loan

- Paying the balance in full

This maintains ownership, resolves the default status, and avoids credit damage from a forced sale.

Fair Vehicle Sale Practices

Lenders must attempt to secure fair market value when selling repossessed collateral.

If you believe they resold your car at an artificially low price, you may have grounds to sue over “commercially unreasonable” sale terms.

Key Takeaways

- Retrieve any personal property free of charge

- Buying back cars before auction is sometimes possible

- Lenders must seek fair resale pricing

How Repossession Impacts Your Credit

Unfortunately, going through repossession damages your credit in several ways at once:

- Missed Payments – Your negative payment history remains for up to 7 years.

- Default Status – Defaulting alone is a black mark even without a seizure.

- Potential Collections – If deficiencies remain after sale, accounts may go to debt collectors.

- Long Recovery – Even keeping accounts current post-repo takes years to recover from.

A car repossession can lower credit scores by over 100 points. It signals serious financial problems to future lenders for many years.

Key Takeaways

- Repos often drop scores 100+ points

- 7 years of damage across payment history, defaults, collections, etc

- Long road to credit recovery even once resolved

How Deficiencies & Other Debts Happen

Unfortunately, a car repossession can leave you still owing money in multiple ways:

Deficiency Balances

If the resale amount doesn’t cover your remaining loan balance, you are on the hook for this “deficiency” sum. Essentially, you still owe money even after returning the car.

Deficiencies are common with new car loans, where rapid depreciation makes resale values far below purchase prices.

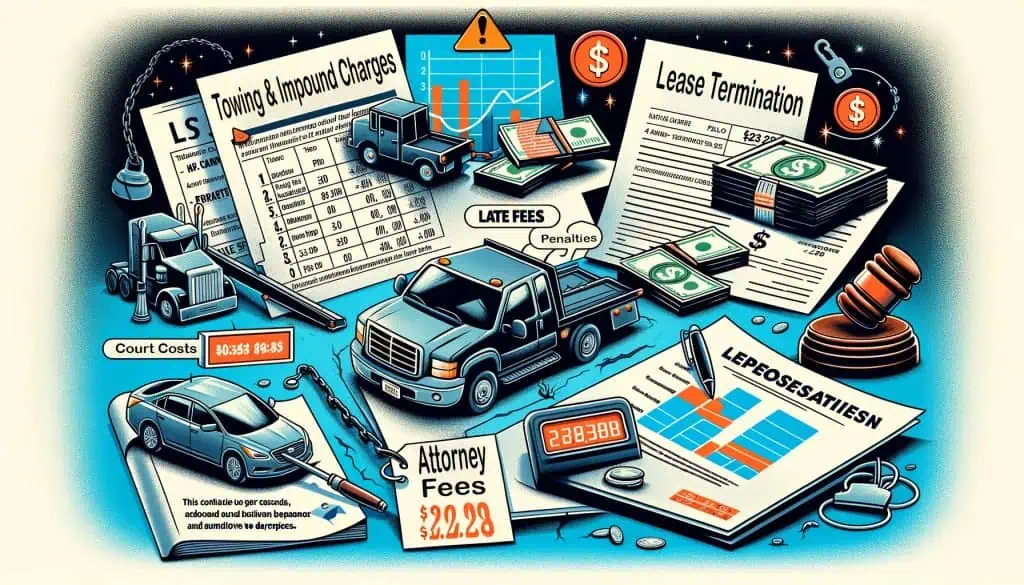

Other Repossession Fees

In addition to deficiencies, you may face other repossession-related debts:

- Towing & impound charges

- Late fees

- Penalties for early lease termination

- Attorney fees

- Court costs if lenders sue for deficiencies

Key Takeaways

- Deficiencies = Owning money leftover even after car sale

- Depreciation contributes to deficiencies

- Various repossession fees may also be charged

How To Avoid Repossession

Losing your car to repossession leads to substantial credit damage and financial issues. Here are proactive solutions for avoiding repos in the first place:

Communicate With Lenders Early

Contact lenders immediately if you foresee upcoming issues with payments. Explore options like short-term deferrals, waiving late fees, or revised payment calendars.

Get any agreements for altered repayment terms in writing. Don’t wait until already behind on payments.

Attempt Loan Refinancing

See if you qualify to refinance your existing car loan through another lender. This pays off the current repo-risky loan with better terms that fit your budget.

Shop for the lowest rates available and ask lenders about “gap coverage” to avoid deficiencies.

Explore Debt Consolidation

A debt consolidation loan folds multiple debts, like credit cards, medical bills, etc, into a single monthly payment.

This helps free up cash for the car bill. Compare top debt consolidation companies for the best terms.

Key Takeaways

- Talk to lenders BEFORE missing payments

- Refinancing replaces upside-down loans

- Debt consolidation frees up monthly cash

What To Do If Your Car Is Repossessed

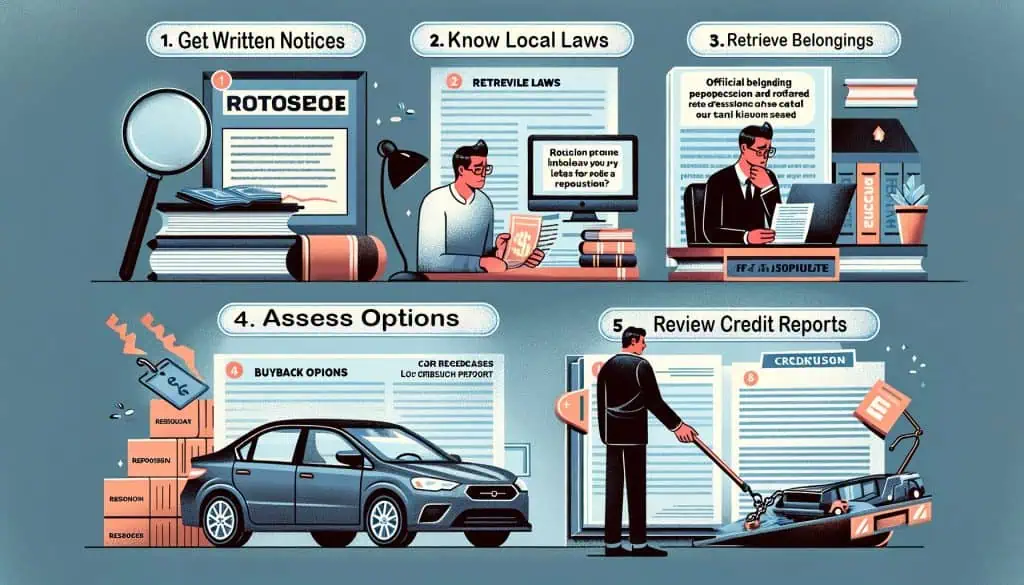

If your vehicle gets repossessed, act quickly to understand the situation and minimize damages:

- Get Written Notices – Request official repossession notifications from lenders immediately. This starts documenting the timeline of events.

- Know Local Laws – Research your state’s specific buyback, reinstatement, and consumer rights statutes. Laws vary regarding buyback windows, surplus liabilities, etc.

- Retrieve Belongings – Inventory and safely remove any personal property left in the seized vehicle. Don’t assume items are lost forever just because your car got towed away.

- Assess Options – Decide whether buyback, reinstatement, or surrender makes the most financial sense for your situation. Don’t panic and assume all is lost.

- Review Credit Reports – Be proactive about fixing any erroneous repossession information appearing on your credit file and disputing mistakes with the bureaus.

Key Takeaways

- Get written notices & know state laws

- Remove personal property ASAP

- Choose best option for buyback, reinstatement, etc

- Dispute any credit report errors

Am I Still Liable as a Co-Signer?

If you co-signed on the repossessed auto loan, you remain equally responsible for any deficiencies or consequences even though you weren’t the primary driver.

Any credit damage falls on co-signers too. Work urgently with primary borrowers to address deficiencies or payment issues before things escalate further.

Explore all protections like loan refinancing, buybacks, reinstatements, etc to avoid worst-case scenarios. Don’t assume primary borrowers will address problems without your involvement.

Key Takeaways

- Co-signers carry same liability as primary borrowers

- Jointly work to avoid repossession using all options

- Don’t rely on primary borrowers alone to fix issues

My Closing Thoughts And Advice

Losing a vehicle to repossession creates substantial long-term credit damage and financial issues. Act decisively at the first signs of payment problems.

Know your rights in the repossession process. Seek opportunities to refinance or reinstate loans with lenders before defaulting.

Limit further harm to your situation and credit by avoiding deficiencies wherever possible. With diligence and borrowing prudence, you can recover and thrive again after even a damaging vehicle repossession.

Resources For This Article:

- https://www.forbes.com/advisor/auto-loans/late-car-payments-heavy-loan-rates/

- https://consumer.ftc.gov/articles/vehicle-repossession

- https://consumer.ftc.gov/consumer-alerts/2020/04/behind-car-payments-because-coronavirus

- https://finance.yahoo.com/news/car-repossessions-reach-decade-high-193516945.html

- https://liftandtow.com/understanding-the-car-repossession-process/

- https://www.justia.com/debt-management/car-repossessions/stopping-repossession/

- https://www.experian.com/blogs/ask-experian/how-can-i-stop-my-car-from-being-repossessed/

- https://www.thecooklaw.com/reasons-to-file-bankruptcy/stopping-auto-repossession/

Legal Disclaimer:

This article provides general information about auto repossession processes, laws, costs, and consumer rights in the United States. Content is intended for informational and educational use only. Consult an attorney licensed in your state for specific legal advice regarding your situation. Information contained herein should not be construed as formal legal counsel or formation of an attorney-client relationship. The author provides no representations, warranties, or assurances about the accuracy, reliability, completeness, currency, or applicability of provided information. The author assumes no liability or responsibility for any errors, inaccuracies, or omissions.