If you need funding to purchase a new or used car, dealership financing can be a convenient one-stop option to take care of everything at the dealership.

However, as a former used car dealer who sold many car loans to buyers with poor credit, I can tell you that these dealer-arranged loans typically come with higher interest rates and fewer consumer protections than financing directly with a bank.

Relevant Articles to Read:

- How Long Does A Car Dealership Have To Get You Financed

- How To Buy a Car With Bad Credit and No Cosigner

- How to lease a car with bad credit

- How To Negotiate Used Car Price

Key Takeaways:

- Car dealerships act as middlemen to secure financing from partner lending institutions at a “buy rate.” The interest rate offered to the customer is marked up from this buy rate so the dealer profits.

- Advantages include convenience, flexible terms for those with poor credit, and access to special manufacturer deals.

- Disadvantages are higher rates, tacked-on fees, and decreased consumer leverage compared to bank loans.

- Getting pre-approved financing before visiting the dealership can help buyers negotiate the best rates.

Table of Contents

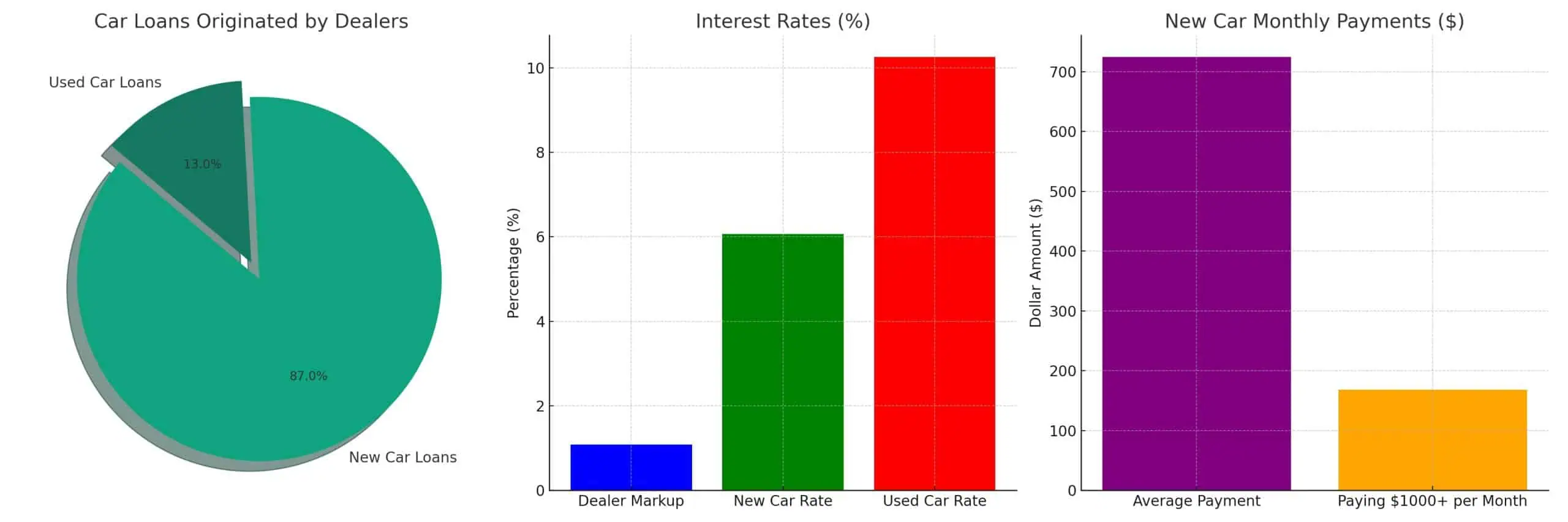

Key Statistics on Dealership Car Financing

Get some perspective on current auto lending rates, monthly payments, and more useful metrics with these statistics:

| Statistic | Figure |

|---|---|

| New Car Loans Originated by Dealers | 60% |

| Used Car Loans Originated by Dealers | 9% |

| Average Dealer Interest Rate Markup | 1.08% |

| Current Average New Car Monthly Payment | $725 |

| New Car Buyers Paying $1000+ per Month | 16.8% |

| Average New Car Interest Rate | 6.07% |

| Average Used Car Interest Rate | 10.26% |

How Does Dealership Auto Financing Work?

The car buying process often begins at the dealership, where the salesperson refers interested customers to the Finance & Insurance (F&I) department if they require financing.

The F&I manager collects your information and submits a credit application to lending institutions that the dealer has relationships with, such as banks, credit unions, and subprime lenders.

These lenders each provide a “buy rate” quote for what baseline interest rate they’d offer your loan at, based on assessing your creditworthiness.

Whichever institution offers you terms the dealer likes best becomes the funding source. However, the final APR presented to you by the dealer will be marked up from this initial buy rate so they can pocket extra profit.

For example, if a bank approves your application at a 7% buy rate, the dealer might offer you financing at an 8.5% APR, taking an extra 1.5% as compensation for arranging it.

Types of Dealership Auto Financing

Dealership financing takes several forms – here is an overview:

| Type | Description | Interest Rates | Requirements | Pros | Cons |

|---|---|---|---|---|---|

| Captive Financing | Loans from manufacturer-affiliated lenders | Can feature promotional rates for new car models / incentives | Strong credit | Access to best possible rates on new models | Very limited flexibility – approval unlikely with low scores |

| Indirect Lending | Dealer acts as middleman arranging loan through partners | Typically marked up 1-3% from buy rate | Less stringent credit needs | One-stop process | Higher rates due to dealer markup |

| Buy Here Pay Here (BHPH) | Dealer is lender, vehicle collateral for loan | Often exceed 15% | Poor credit or no credit needed | May be only option for very bad credit | Aggressive down payment terms and likelihood of repossession |

Getting the Best Deal on Dealership Financing

Here are some tips to negotiate the lowest interest rate when financing your car through a dealer:

Get Pre-Approved Financing Elsewhere First

Having a pre-approved loan offer from a bank or credit union in hand gives you crucial leverage when it comes to dealing on rates. Inform the dealer you have alternate financing already and firmly negotiate to get them to beat your pre-approval terms.

Improve Your Credit Score

Buyers with higher credit scores inherently qualify for better interest rates. Review your credit report beforehand and dispute any errors that could be unfairly lowering your score.

Make a Sizable Down Payment

Putting 20% or more down on the vehicle purchase price minimizes risk from the lender’s side. This allows them to offer better rates. Save up if you can.

Decline Unneeded Add-Ons

Avoid tacking on things like extended warranties and GAP insurance to your loan, as a higher principal amount borrowed equals more interest paid. Only include what you truly need.

When Does Dealership Financing Make Sense?

For certain buyers, there are clear benefits to financing your car directly through the selling dealer:

Subprime Borrowers: Those with poor credit may find dealer financing their only path to securing an auto loan at all. Just be aware rates and terms will likely be aggressive.

Seeking Maximum Convenience: Applying and completing everything at once at the dealer is easier if you value time over finding the absolute lowest rates.

Qualifying for Special Offers: Select manufacturers provide special promotional financing rates through their captive lender partners, but these usually require strong credit.

Pros of Dealership Auto Financing

One-Stop Process: Find a car, test drive, negotiate price, and handle financing all in one spot. No need to coordinate separate loan applications.

Flexibility for All Credit Types: The dealer can access loans for those with bad credit or unique situations that couldn’t qualify elsewhere.

Access Exclusive Manufacturer Deals: Some OEM captive lender promotions feature below-market interest rates only for their brands bought at franchise dealers.

Smoother Purchase of Used Cars: Banks shy away from financing older or high-mileage vehicles. Local dealers arrange these loans easily via contacts.

Cons of Going Through a Car Dealer for Financing

Higher Interest Rates: The “buy rate” from the lender is marked up so the dealer profits on the loan. This can add over 2% extra versus direct financing sources.

Decreased Control: The dealer chooses which lending institutions see your application, not you, so you have less leverage negotiating terms.

More Fees Tacked On: Loans arranged by dealers frequently pile on extra documentation fees and processing charges.

Potentially Risky for Subprime: Buy Here Pay Here and other dealers specializing in bad credit loans can carry alarming down payment requirements and sky-high rates.

Table Comparing Dealership Financing vs Bank Loans

| Metric | Dealership Financing | Bank/Credit Union Loans |

|---|---|---|

| Interest Rates | Usually 2%+ higher due to dealer markup | Typically lower without markup |

| Qualifying Requirements | More flexible terms for those with poor credit | Stricter credit score cutoffs |

| Haggling Leverage | Less ability to negotiate rates/terms | Pre-approvals empower buyers leverage-wise |

| Extra Fees | Often additional doc fees and charges | Lower or no fees generally |

| Convenience Factor | Faster overall process start to finish | More legwork shopping rates separately |

Alternatives to Going Through a Car Dealer for Financing

If you don’t love the terms the dealership can offer, here are a few alternative places to finance your auto loan:

Bank or Credit Union Loans

The most common direct source for financing. Building relationships over time can help you qualify for lower rates.

Online Lenders and Marketplaces

LendingTree, Lightstream, and similar networks contain offers from multiple competing lenders. This simplifies rate shopping.

Credit Unions

Credit unions frequently offer the most competitive interest rates and have membership requirements instead of credit cutoffs.

Personal Loans

From sources like SoFi or Payoff, these unsecured installment loans typically feature much shorter 2-5 year terms compared to auto loans but have fixed rates and no vehicle as collateral.

Key Auto Loan Terminology Definitions

Annual Percentage Rate (APR):

The total yearly cost of borrowing money is expressed as a percentage rate to encompass interest charges plus any fees.

Buy Rate:

The wholesale rate a lender initially offers a dealer to fund a customer’s loan before markup. This baseline rate is kept hidden from the buyer in most cases.

Amount Financed:

This key number represents the actual dollar amount being loaned to you by a lender to purchase the vehicle.

Monthly Payment:

The amount due each month toward repaying the auto loan balance over the multi-year term of the loan. Try to get this number as low as possible.

FAQs About Car Dealership Financing

1. Can I get pre-approved for dealer-arranged financing?

Dealers themselves don’t usually offer pre-approvals, but having a pre-approved loan from another lender strengthens your negotiating position.

2. What credit score do I need for dealer financing?

Each dealer sets their own requirements, but scores above 600 have the best shot. Subprime dealers work with applicants having scores in the 300-500 range frequently.

3. Are dealer interest rates always higher than banks?

In most cases, yes. By marking up the buy rate, dealers build in extra profit from arranging the financing. Those with top tier credit can sometimes qualify for rare 0% interest promotions at the dealer though.

4. What fees might be charged for dealer-arranged loans?

Common fees include documentation/processing administrative fees, typically $200-500. Some dealers also tack on dubious fees like etching or extended warranty fees tied to loans.

The Bottom Line

While dealership financing provides a simpler one-stop route to paying for your new car, take the time to check bank, online lenders, and credit union interest rates beforehand.

Even getting quotes rather than formal pre-approvals equips you better to negotiate the lowest rate possible at the dealership F&I office.

For buyers in a rush, those with credit troubles, or applicants chasing special captive finance offers only, dealer-arranged loans certainly still have their place, serving customer needs conveniently.

Just be educated on the usual 2%+ rate premium incurred for the expediency and what unwanted fees to watch out for.

Sources and References:

- https://www.mckinsey.com/industries/financial-services/our-insights/disruption-and-innovation-in-us-auto-financing

- https://finmasters.com/car-loan-statistics/

- https://www.statista.com/statistics/290673/auto-loan-rates-usa/

- https://www.marketwatch.com/guides/car-loans/auto-loan-interest-rates-by-credit-score/

- https://www.policygenius.com/auto-insurance/dealer-financing-vs-getting-a-car-loan-from-a-bank/

- https://www.gregoryhyundai.com/Why-Finance-Through-A-Dealership

- https://www.creditkarma.com/auto/i/get-best-deal-on-car

- https://www.jdpower.com/cars/shopping-guides/how-does-car-dealership-financing-works

- https://www.cars.com/articles/how-to-win-the-car-financing-game-1420681041077/