If you’ve shopped for used cars, the term “certified pre-owned” or CPO has likely come up.

Definition:

Certified pre-owned cars are late-model used vehicles that have undergone extensive inspection and refurbishing by the manufacturer.

As a former licensed used car dealer, I regularly purchased cars that fell within the guidelines to be certified used cars.

And the very first thing I did was contact local dealers of the same manufacturer to see if they were interested. That’s how much additional value these cars hold!

Key Takeaways on Certified Pre-Owned Vehicles:

- CPO cars are rigorously inspected and reconditioned to meet strict factory standards. They must be accident-free with low mileage, often less than 5 years old and under 80,000 miles.

- You pay a premium of around 3.5% for a CPO car to cover the certification costs, but they come with an extended warranty backed by the manufacturer for added peace of mind.

- Buying CPO gives you savings over new while still getting a late-model car that’s been thoroughly vetted and looks almost brand new.

- While costs are higher than comparable used vehicles, the inspection, warranty, and extras like roadside assistance or maintenance can offset long term repair costs.

Many shoppers wonder – are certified pre-owned cars really worth it?

For buyers wanting greater assurance when purchasing used, they certainly can be. But CPO vehicles aren’t one-size-fits-all, so you need to weigh the tradeoffs, as we’ll explore in this guide.

Table of Contents

Defining Certified Pre-Owned Cars & Their Key Traits

Certified pre-owned vehicles have been thoroughly inspected, repaired, and refurbished to meet strict standards by the dealer and manufacturer before resale to you.

Specific requirements for the age, mileage, condition, and past history of a CPO car vary between automakers, but share the key traits of:

- A late-model used car, often 3-5 years old or less when certified

- Low mileage, usually under 80,000 miles and often less

- Accident and damage-free based on checks of its vehicle history

- Rigorously inspected against a multi-point checklist by factory-trained technicians

- Repaired and reconditioned until deemed to be cosmetically and mechanically sound

- Extended limited warranty coverage backed by the manufacturer after purchase

So in essence, you are buying a lightly used, accident-free car that looks almost new off the dealer lot and has passed thorough inspection.

As the vehicle’s past owner, the dealer and manufacturer now stand by it via the remaining factory warranty plus an extended CPO warranty they provide.

Many CPO cars were leased new then well-maintained by a single prior owner before trade-in when the lease ended. Others are “cream of the crop” used models taken as trade-ins that met stringent standards.

Dealers recondition these quality used cars to ensure they are cosmetically and mechanically sound.

Then, the manufacturer certifies them under their CPO program once multi-point inspection, repairs, and refurbishment meet specifications.

This transformation from a lightly used car to a CPO vehicle is why you’ll pay a premium of around 3.5% on average compared to similar non-certified cars.

You are paying for the vehicle inspection, reconditioning, manufacturer’s extended warranty, and additional peace of mind when buying used.

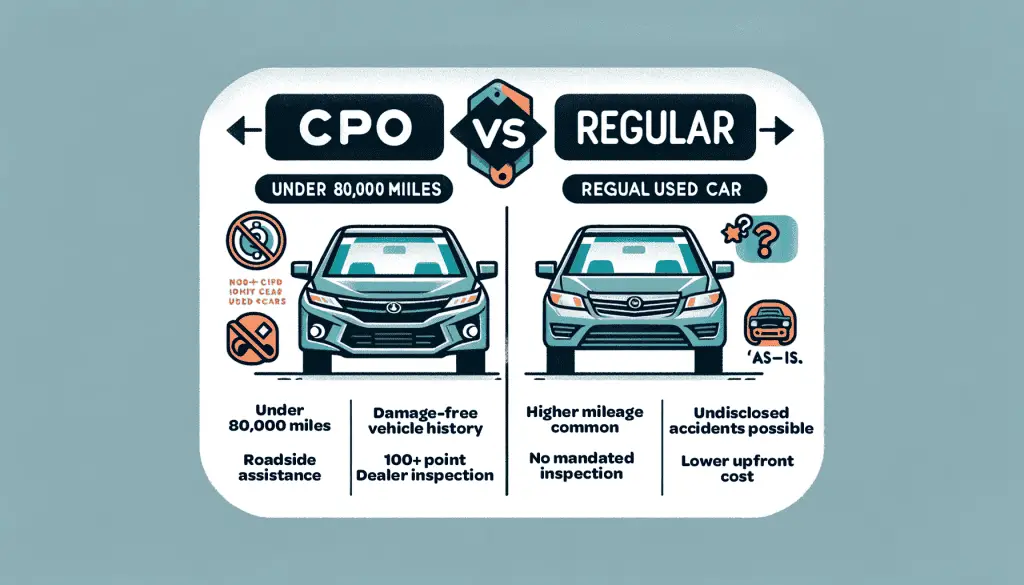

How Certified Pre-Owned Differs from Regular Used Cars

On the surface, CPO and regular used cars may seem very similar since they are both pre-owned. But there are a few key differences to understand:

| Certified Pre-Owned | Regular Used |

|---|---|

| Typically 3-5 years old or less | Any age from old to late model |

| Always under 80,000 miles & often less | Higher mileage common |

| Accident & damage-free vehicle history | Undisclosed accidents possible |

| Rigorous ~100+ point dealer inspection | No mandated inspection |

| Refurbished to strict factory standards | Sold as-is condition |

| Extended manufacturer warranty | No warranty unless remaining factory coverage |

| Perks like loaner cars, roadside assistance | No additional perks |

| 3.5%+ price premium on average | Lower upfront cost |

While used cars offer a lower initial price point and come in all shapes and sizes, certified pre-owned models bring reliability and peace of mind. You know a CPO car has passed thorough inspection, has no significant history issues, meets higher conditioning standards, and has warranty coverage for defects.

But which route – certified pre-owned or traditional used – makes the most financial sense for you? Let’s break down the pros and cons of CPO vehicles more.

The Pros & Cons of Buying Certified Pre-Owned Vehicles

| Pros of CPO Cars | Cons of CPO Cars |

|---|---|

| * Saves money over buying new | * Higher upfront cost than regular used |

| * Looks and drives almost like new | * Fewer vehicle options and limited inventory |

| * Warranty provides peace of mind | * Still shows normal wear-and-tear |

| * Special financing rates available | * Doesn’t guarantee a problem-free car |

| * Extras like loaners and roadside assistance |

There are some clear benefits of opting for a certified vehicle over a traditional used car if budget allows. But CPO vehicles also have downsides to weigh. Let’s break these pros and cons down further.

Key Benefits of Choosing a Certified Pre-Owned Car

1. Save Money Over Buying New

CPO programs allow car shoppers to access lightly used vehicles for significant discounts over new ones.

A 3-year old CPO car often sells for 40% or more below its original sticker price.

These savings over new come without the extreme depreciation hit you’d take by buying new and trading in several years later.

2. Vehicle History Checks and Inspections Provide Peace of Mind

All CPO vehicles come with checks of their vehicle history to rule out any past accident damage or use as former rentals, taxis, etc.

Then every car must pass a certified mechanic’s multi-point inspection of all major systems before earning its CPO designation.

You can actually request a copy of the inspection from the dealer to understand what has been rigorously checked over.

Between the history and inspection, manufacturers and dealers stand by these vehicles as the cream of the used car crop. This assurance goes a long way for nervous used car buyers.

3. Extended Warranty Coverage

Rather than buying an add-on service contract of questionable value, CPO cars come with an extended warranty backed by the manufacturer. Term lengths for the extended coverage vary, but provide protection for 1 year/12,000 miles on average, sometimes longer.

The warranties offer both:

Bumper-to-bumper coverage – This covers repairs on any factory-installed mechanical or electrical components excluding normal wear items. Powertrain coverage – The extended powertrain warranty covers expensive transmission, engine repairs and more.

Coverage from the CPO warranty keeps you from paying repair bills out of pocket.

Between the inspection and the warranty, CPO vehicles provide greater security to used car buyers concerned about unexpected issues down the road.

4. Special Financing Deals and Rates

Since certified pre-owned cars are lower risk, automakers want to incentivize purchases with attractive financing too.

Most manufacturers promote current purchase deals or financing rates for CPO models on their websites or you can discuss options with the dealership.

Due to the car being manufacturer-backed, special rates under 2-3% for certified models are common for buyers with good credit.

5. Little Additional Perks

To further endear drivers to CPO vehicles, manufacturers include nice extras as well at no charge. Most CPO programs bundle in benefits like:

- 24/7 Roadside assistance for tows, jumps starts, lockout service, fuel delivery

- Free loaner or rental cars when your car is being serviced

- Single deductible across all warranty repairs

- Trip expense reimbursement for food, lodging if break down away from home

- Free satellite radio and navigation map updates for 1 year

- Free maintenance package providing oil changes and inspections

Altogether, CPO perks provide security and save money over time. They make the higher asking price on certified models easier to swallow.

What Are the Downsides of Choosing a Certified Pre-Owned Car?

On the flip side, CPO vehicles do pose some drawbacks that come with the extra assurance. Main downsides are:

1. Costs More Upfront Than a Comparable Used Car

It takes a lot of time and money for dealers to acquire quality used cars, thoroughly inspect them, make repairs, recondition them cosmetically, and finally get manufacturer approval.

These investments in transforming the car into certified pre-owned status turn up on the asking price.

Depending on the model, you’ll typically pay a few thousand dollars more for a CPO version of a car over its used equivalent.

For some makes or popular models, the premium charged on CPO examples is significant enough that shoppers can likely find cheaper used alternatives without certification. Always compare prices.

2. Limited Vehicle Options Compared to All Used

Since every CPO car has to pass such strict criteria for age, past history, and current condition, inventory is always far more limited compared to all models available used.

Often dealers will have less than 10-15 certified pre-owned examples of a given model when they may have 50+ used version variants.

So availability of certain vehicles, trims, colors and option combos will be restricted in CPO world. Expect to have far fewer vehicles to choose between and likely need to compromise to find “the one”.

3. Normal Wear and Tear Due to Past Use

While certified pre-owned cars must be mechanically sound, they lived a previous life before trade-in and certification.

So some light scratches, door dings, upholstery wear, and faded trim are expected even on CPO cars compared to factory new.

Again, set reasonable expectations around the “newness” factor of vehicles already 3+ years old.

During your test drive, inspect wear items more closely including tires, brake pads, shocks/struts and batteries.

Check for fluid leaks too. Dealers often won’t replace items still having 40-50% life left even when reconditioning for CPO sale, leaving you the eventual cost.

4. Doesn’t Guarantee a Problem-Free Vehicle

Lastly, while rigorous inspection and refurbishing mean a CPO car is far less risky than traditional used cars, there is always a chance of issues popping up.

Past owner neglect or abuse, manufacturing defects slipping through the cracks, and regular wear items failing down the road remain possibilities.

Extended CPO warranties mitigate most repair costs concerns but aren’t an absolute guarantee against repairs.

As with any used car purchase, having an independent mechanic inspect the CPO vehicle beforehand to confirm mechanical soundness is smart.

Test drive yourself thoroughly, too, and don’t assume “certified” status means no blemishes whatsoever.

Certified Pre-Owned Industry Trends and Statistics

| Metric | Data Points |

|---|---|

| Problems Over Lifetime | CPO vehicles have 11% more issues than new, but 31% fewer than non-CPO used |

| Owner Satisfaction | 11% higher chance CPO owners will re-buy the same vehicle |

| 2022-2023 Sales Growth | Up 7% year-to-date through July with Toyota and Honda leading |

| Credit Availability | It is currently the tightest lending environment currently on CPO loans per Cox Automotive. |

Factoring in Future Savings When Deciding If CPO Is Worth It

Given their higher asking price, are certified pre-owned vehicles really a smart money move for shoppers? It depends greatly on the car make and model in question.

The extra certification cost may not pay off for reliable, economical-to-own used cars known for easy repairs.

Alternately, some luxury or performance brands have notoriously pricey parts and repairs.

Here, certification, combined with the extended warranty it provides, can potentially offset thousands in future complex repair bills.

When deciding if paying up for a CPO example of a given vehicle seems rational, consider these savings areas:

1. Lower Finance Rates Save over Loan Term

Special CPO new car financing rates from the manufacturer also apply when you purchase their certified pre-owned cars too.

Thanks to their backing of these used vehicles, most automakers offer reduced APR incentives on certified models to prime the path for sales.

As an example, Toyota is currently offering 1.9% APR financing for 60 months on their CPO cars.

At that rate, buying a $15,000 CPO Camry would save you $608 in interest charges over 5 years versus taking a typical used car loan at 7%.

So factor the savings from lower CPO loan rates into your cost benefit analysis.

2. Warranty Protections Against Expensive Repairs

The extended CPO vehicle warranty also provides massive financial protection should a major issue arise.

Say the engine needed replacement at a cost of $5,500 without labor factored in yet on an Audi you purchased used…

their 4 year/48,000 mile CPO warranty on certified models would completely cover that repair bill for you.

This security against devastating bills is why that premium paid upfront can pay dividends.

Similarly, bumper-to-bumper coverage would pay for a new AC compressor, electronics repairs, even suspension or brake issues. Then bundled roadside assistance and loaner cars keep you on the road if repairs take a few days.

Altogether CPO warranty protections likely save you thousands over time.

For simple math on the warranty factor, research what your vehicle’s average repair cost is historically via RepairPal or Consumer Reports. Let’s assume $650.

If you kept the car 5 years after buying CPO, then you’d only need ONE repair covered in that span of ownership for the extra 3.5% premium to pay for itself entirely.

3. Stronger Resale Value Even Years Later

Finally, certified pre-owned cars typically command a few percentage points more resale value down the road, thanks to their factory backing.

Example: Assume you paid a $700 premium for a certified version of a used vehicle ($17,000 CPO vs. $16,300 for a regular used vehicle). After five years, when both are again worth 30% of their original value as 12-year-old cars, that 3.5% premium translates to nearly $1,000 at trade-in time (30% of $17k = $5,100 vs. 30% of $16,300 = $4,890).

So, the long-term value story clearly favors the certified option, allowing you to recapture that initial investment years later. This helps offset the higher used car price paid at the start.

Steps to Buying a Certified Pre-Owned Vehicle

If you’ve weighed the pros and cons of certification and are ready to start shopping CPO cars, here is an overview of the process:

1. Research Options, Budget & Check Current Deals

Get clarity on makes/models that interest you, factoring year, mileage, and pricing estimates into a target budget.

Then, check automaker websites for current purchase deals or special financing rates offered on CPO cars as these rotate frequently.

Knowing incentives available on certain models helps determine the best values.

Quick tip: Don’t forget to have your trade-in valued too via Kelley Blue Book Instant Cash Offer or another site. This gives you an accurate payoff amount when applying for financing.

2. Check Local Inventory Listings

Next research actual certified pre-owned inventory available near you on sites like Autotrader, Cars.com, CarGurus or direct automaker sites like Toyota’s.

Filter specifically for CPO status, your desired make/model, budget range etc. to narrow the field.

Run each vehicle’s VIN through FAXVIN or another decoder site to validate its trim, options, accident history and specifications before visiting lots.

3. Test Drive and Inspect The Vehicle

Schedule test drives of your favorite certified candidates when you’ve identified trucks that look promising. Here you’ll validate condition yourself since CPO doesn’t guarantee a perfect car.

Focus on test driving, paint flaws, interior wear, tire tread etc. Ask the dealer for a copy of the vehicle history report and their inspection sheet too if desired.

4. Negotiate Your Best Price

Unlike new cars, certified pre-owned vehicle prices tend to have more flex. Check a fair asking price via pricing guides like Edmunds True Market Value tool first.

Then make an offer if the lot price looks inflated. Highlight competitive vehicles you’ve seen listed lower if the dealer won’t come down for additional leverage.

5. Review Sales Contract & Warranty

Carefully examine what coverage is included with the certified warranty by requesting the full contract. Understand time and mileage limits along with any deductible charges.

Also verify special financing terms and that loan APR matches what the dealer originally quoted you. Then sign paperwork once satisfied.

My Final Thoughts: Finding the Right Pre-Owned Vehicle

In the end, traditional used cars and CPO offer very different value propositions to buyers. As a former dealer though, I guided countless shoppers toward almost-new CPO vehicles for their peace of mind.

While certified pre-owned examples may cost more upfront, they stack up well as savvy purchases for certain buyers valuing low-risk, high-quality used cars with manufacturer backing.

Just be sure to research the market carefully, understand total costs, leverage negotiating power, and focus on the long-term savings CPO warranties provide.

Hopefully this guide has helped explain exactly what certified pre-owned means while empowering your search for the perfect car. Let me know if you have any other used car questions!

Sources and References:

- https://www.prnewswire.com/news-releases/majority-of-americans-would-consider-buying-used-vehicles-300967731.html

- https://www.edmunds.com/about/press/edmundscom-survey-reveals-strong-consumer-interest-in-certified-pre-owned-vehicles.html

- https://www.jdpower.com/business/data-and-analytics

- https://www.cars.com/articles/are-certified-pre-owned-cars-worth-it-426164/

- https://www.caranddriver.com/features/a28924863/buying-cpo-pros-cons/

- https://www.coxautoinc.com/market-insights/used-vehicle-inventory-july-2023/