Are you gifting or inheriting a car from a family member in Illinois?

You’ll need to properly transfer the vehicle’s title to comply with state laws.

As a former car dealer, I’ve helped many customers navigate the title transfer process to avoid some of the most common issues.

This article will explain all the steps, requirements, and fees to successfully transfer a car title to a family member in Illinois.

Relevant Articles To Read On Car Titles:

- How Much Is Gift Tax On a Car

- What is an Instant Title

- How to Transfer A Car Title to a Family Member in Another State

- Can You Add Someone To A Car Title?

- How to Fix Written Mistake On Car Title When Selling

- How To Sign Over A Car Title

Table of Contents

Key Title Transfer Differences – Family Members vs Non-Relatives

The key differences when transferring a vehicle title specifically to a family member in Illinois compared to a non-relative are:

Fees

- Lower taxes in most cases due to $0 or very low sale price for intra-family gifts/sales vs higher sale prices for non-relatives

- Added $15 title transfer correction fee that applies for family members

Documentation

- Gift documentation or $0 bill of sale often needed for family members instead of higher sale price bill of sale

- Beneficiary, death certificates, or probate paperwork may be required for inheriting family vehicles that don’t apply for standard sales

Expedited Process

- Family transfers can often be expedited if paperwork confirms relationship status

- Non-relatives undergo standard title transfer timing

Registration

- More flexibility to retain family registration and plates vs changing for non-relatives

In-Person Appearance

- Family members can sometimes mail in paperwork if unable to appear in-person together at Secretary of State office

Why a Title Transfer Is Necessary

Transferring the title is crucial whenever vehicle ownership changes – even within families. The title legally proves ownership. Without it in your name:

- You can’t register or insure the car.

- You have no legal right to drive the vehicle.

- You can face fines or have the car impounded if stopped by police.

Don’t mean to scare you! But I want to stress the importance of promptly transferring the title after receiving a family vehicle for everyone’s protection and convenience.

Now let’s explore the process so you can gain that peace of mind of clear vehicle ownership.

Key Requirements for Illinois Car Title Transfers

To transfer ownership to a family member in Illinois, you typically need:

- Signed-over title from the seller/relative listing the new buyer’s name and info

- Odometer disclosure stating the mileage

- VSD 190 application form submitted in the buyer’s name

- Taxes filed (Form RUT-50)

- Title fees paid ($110 total for family transfers)

Specific instructions for transfers involving inheritance, beneficiaries, and trustees will be covered later.

But first, let’s look at the nitty gritty details and fees involved…

Title Transfer Cost in Illinois

When transferring a vehicle title in Illinois, the costs and fees can vary depending on whether you are transferring the title to a family member or to a non-family member (private party).

Here’s a table and a list outlining the costs and potential costs for both scenarios:

| Cost Item | Transfer to Family Member | Transfer from Private Party (Non-Family) |

|---|---|---|

| Title Transfer Fee | $95 | $155 |

| Registration/License Plates | $151 | $151 |

| Vehicle Use Tax | $15 | Regular tax based on purchase price (see list below) |

| Duplicate/Corrected Title (if needed) | $50 | $50 |

| Late Transfer Penalty Fees | $20 – $100 (based on delay) | $20 – $100 (based on delay) |

1. Title Transfer Fee:

- Transfer to Family Member: $95

- Transfer from Private Party (Non-Family): $155

2. Registration/License Plates:

$151 (same for both scenarios)

3. Vehicle Use Tax:

- Transfer to Family Member: $15 flat fee

- Transfer from Private Party (Non-Family):

- Purchase price less than $15,000: Tax based on a schedule (e.g., $115 for $10,000 purchase price)

- Purchase price $15,000 or more: Tax based on a different schedule (e.g., $850 for $15,000 – $19,999.99 purchase price)

4. Duplicate/Corrected Title (if needed):

$50 (same for both scenarios)

5. Late Transfer Penalty Fees (if the transfer is not completed within 30 days):

- 30-60 days late: $20 penalty

- 60-90 days late: $35 penalty

- 90-120 days late: $65 penalty

- Over 120 days late: $100 penalty

The main differences in fees are:

- The title transfer fee is lower ($95) when transferring to a family member compared to a non-family private party ($155).

- The vehicle use tax is a flat $15 fee for transfers to family members, while it is based on the purchase price for non-family private party transfers.

All other fees, such as registration/license plates, duplicate/corrected title fees, and late transfer penalty fees, are the same for both scenarios.

Now that you know the potential costs, let’s look at the step by step process to transfer a title from a family member whether through selling, gifting or inheritance.

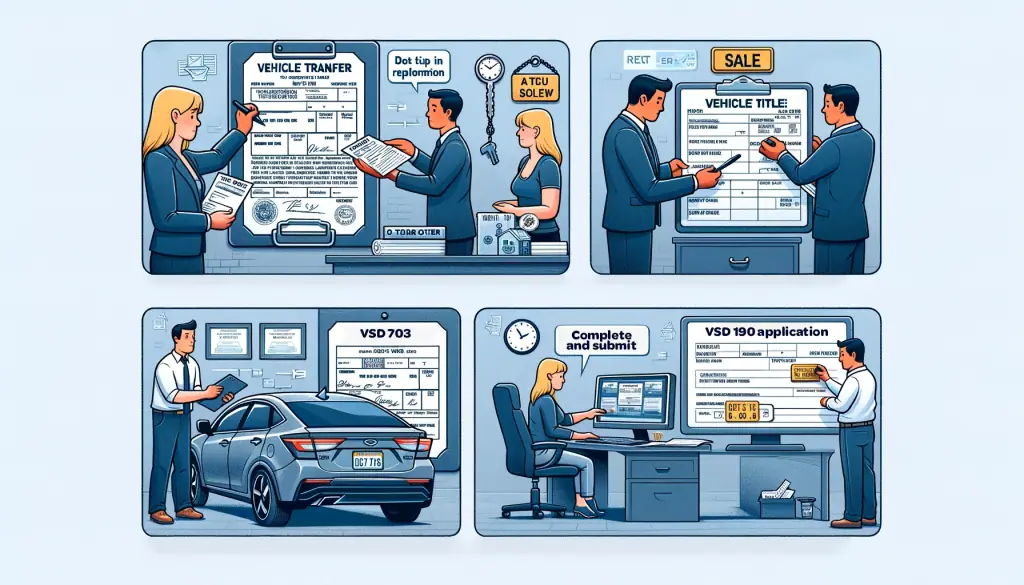

Title Transfer Process When Selling to a Family Member

If you’re selling your car to a family member in a private sale, follow these steps:

- Sign-over the vehicle title by filling in the new buyer’s name and address, odometer reading, date of sale, and signing your name in the “Assignment of Title” section.

- The buyer must complete and submit the VSD 190 application within 20 days to the Secretary of State’s office. This standardized form has all the vehicle details. It can often be completed online via the Electronic Registration and Title (ERT) system for convenience.

- The buyer also needs to file a Private Party Vehicle Tax Transaction form (RUT-50) and pay any applicable taxes owed based on sales price and vehicle value to the Secretary of State.

- As the seller, remove your license plates and complete the Seller’s Notice of Sale form (VSD 703) to notify the Secretary of State you sold the vehicle. This releases liability.

- After the buyer submits all paperwork and fees, the state will issue them a new title with their name as owner.

So in summary, the seller signs over the title, buyer submits title application materials, pays fees, and IL SOS transfers ownership legally!

Title Transferring Process When Gifting a Vehicle

Gifting a car to a family member is also common. As the giver, follow these Illinois title transfer steps:

- Sign-over vehicle title by listing the family member’s information in the “Assignment of Title” section. Put $0 for sale price.

- The recipient submits the VSD 190 form to the SOS within 20 days with the signed-over title.

- They must also file taxes on the car’s value via the RUT-50 tax form, typically between $15-$30.

- Pay the $110 in total transfer/correction title fees.

- Once submitted and processed, the Secretary of State mails out a new title in the family member’s name.

Make sure to accurately assign and record miles on the odometer disclosure when initially signing over ownership on the title.

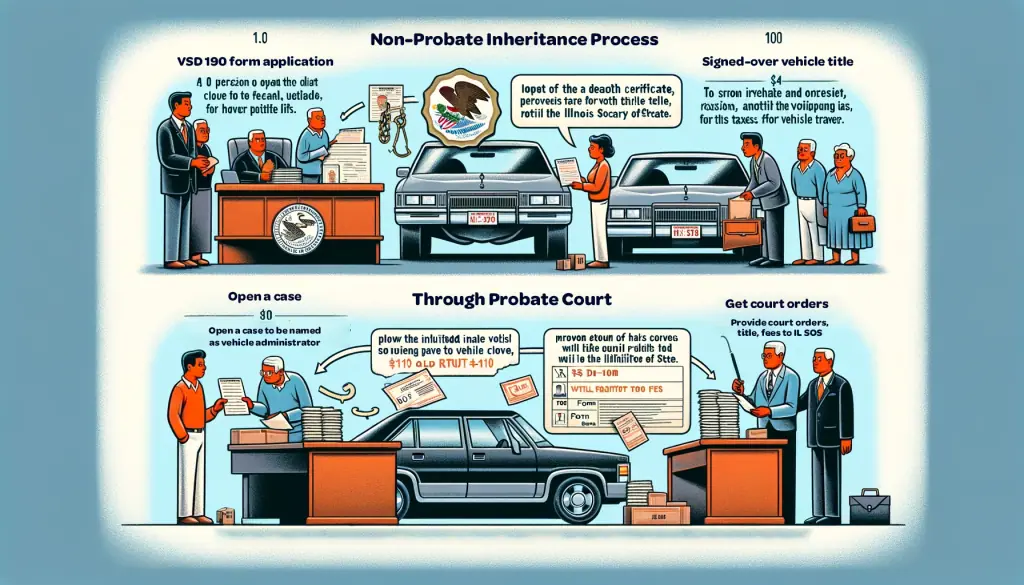

Transferring Vehicle Ownership After a Death

Inheriting a family car after the owner’s passing follows a uniform procedure but gets more complicated if probate is involved.

Here are quick steps for spouses and beneficiaries:

Non-Probate Inheritance Process

- Provide Secretary of State office with:

- Death certificate

- Signed-over vehicle title from survivors

- VSD 190 form application

- Taxes paid (Form RUT-50)

- $110 title transfer fees

- New title issued in beneficiary’s name

Through Probate Court

If assets exceed $100k+ value and no beneficiary/will paperwork exists, you’ll need to contact Probate Court.

- Open a case to be named as vehicle administrator

- Get court orders assigning ownership

- Provide court orders, title, fees to IL SOS

- New title issued in your name after probate closes

probate is often long. Don’t drive inherited vehicles until your name is officially on the new title. Every situation is different – ask the Probate Court clerk to ensure you properly transfer family car ownership after a death.

Transferring an Out-of-State Title From a Relative

Did you receive a car with an out-of-state title from a family member who moved to Illinois or is giving you their old vehicle? As the recipient, here is what to do:

- Get the signed-over out-of-state title from the family member

- Complete the Illinois VSD 190 form with vehicle details

- Provide Secretary of State office a bill of sale/gift document listing $0 if gifted

- Submit taxes via RUT-50

- Pay $110 total in title transfer and alteration fees

- Mail paperwork to Springfield SOS office

- Your new Illinois title is issued after processing

This must be done within 30 days of the relative bringing the car into Illinois. Penalties can apply if late.

Locations to Finish the Illinois Car Title Transfer

You can submit all your paperwork, forms, fees, and signed title in person at a Secretary of State Driver Services facility nearest you.

Find locations here.

Or mail your title transfer application documents to:

Secretary of State

Vehicle Services Department

501 S 2nd Street

Springfield, IL 62756

I recommend submitting it in person during business hours whenever possible so you can ask questions, double check forms are filled out properly, and avoid documents getting lost by mail.

But the mailing address has its place if life is busy and can’t get to an office conveniently!

Key Takeaways – Smooth Illinois Family Title Transfers

- Make sure to sign-over the title, disclosure odometer, provide taxes and fees to legally change ownership records. Shortcuts will only cause issues later!

- Understand probate processes if inheriting vehicles after the death of relatives listed as sole owners.

- Submit paperwork ASAP upon any ownership change – you typically have 20-30 days as a buyer to finish registering it to avoid penalties.

- Seek help from the SOS office clerks or myself as a former dealer if you have any additional questions!

My Closing Thoughts

I hope this guide gives you confidence on the way forward to easily change that family vehicle’s title into your name hassle-free following state laws. Let me know in the comments if you have any other Illinois title transfer questions!