If you are buying a car and have arranged financing through the dealership, they may ask you to sign a bailment agreement before driving off the lot. But what is a bailment agreement, and is it in your best interest?

A bailment agreement allows the dealer to take back the car if they can’t secure financing at the terms promised. The agreement gives temporary possession to the buyer until final loan approval occurs.

While bailment agreements can offer helpful clarity in certain situations, some unethical dealerships use them to engage in “bait-and-switch” financing tactics after the buyer has taken possession of their dream car.

Below, I will examine bailment agreements in depth, including potential benefits, risks, key questions to ask, and recommendations so you can make an informed decision before signing on the dotted line.

Related Articles To Read:

- Possible Red Flags or Signs of a Scam When Buying a Car

- What Kind of Lawyer Do You Need to Sue a Car Dealership

- Reasons to Sue a Car Dealership

Table of Contents

What is a Bailment Agreement?

In simple terms, a bailment agreement is a temporary legal contract outlining the custody transfer of a vehicle between the car dealer (bailor) and the buyer (bailee).

It allows the buyer to take possession of a vehicle before financing is formally approved by the bank. The buyer essentially takes the car temporarily based on the dealer’s word.

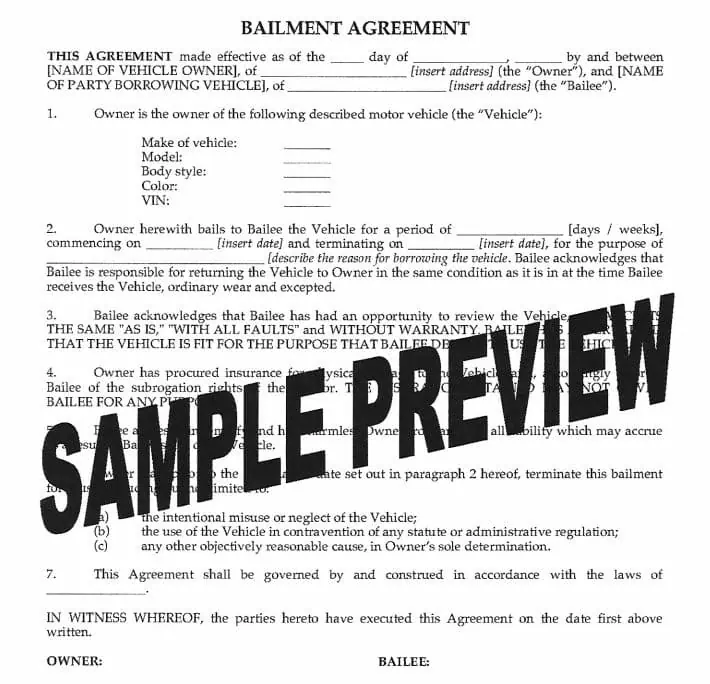

Car Dealership Bailment Agreement Sample

Key Details of Bailment Agreements

- Conditional ownership transfer: Legal ownership stays with dealer until financing terms are met

- Specifies purpose of agreement – test drive, awaiting loan approval, etc.

- Outlines duties & responsibilities of dealer and buyer

- Often sets restrictions around mileage, location, proper vehicle care

Potential Benefits of Signing a Bailment Agreement

There are a few scenarios where having a formal bailment agreement in place could provide advantages:

- Clarity on terms: Clearly documents conditional ownership transfer, duties, and restrictions

- Peace of mind with responsibility & liability spelled out

- Secures vehicle during repairs or when buying from a private seller

However, the most common reason dealers ask buyers to sign one is when financing isn’t finalized yet.

Let’s dive deeper into this specific context and the associated risks and tactics to watch out for.

Spot Delivery & Deceptive Financing Tactics

Many dealers focus on streamlined “spot deliveries” – completing the entire car buying process as quickly as possible so the happy customer can drive their new vehicle home right away.

To achieve this instant gratification, they take your financing application and submit it for preliminary approval from banks and lenders. But this initial approval could have inaccuracies or get denied upon further review.

By having a signed bailment agreement in place, it gives the dealer leverage to call you back and renegotiate if financing falls through at the original promoted terms. They can legally threaten you to:

- Return the vehicle

- Put more money down

- Accept higher monthly payments

- Exchange the car for a cheaper model

And you might feel forced to agree in order to keep the car you fell in love with and already spent time customizing and showing off.

Warning Signs of Spot Delivery Financing Scams

These concerning signals could indicate the dealer isn’t firm on financing and hopes to bait-and-switch terms through a bailment agreement:

- Pushes for an instant spot delivery

- Offers monthly payments or interest rates that seem too good to be true

- Hesitant to provide finalized loan documents and lender contact information

- Asks you to sign a temporary bailment agreement

Evaluating a Bailment Agreement with a Car Dealer

Before agreeing to a bailment contract as part of your dealership financing:

Carefully Scrutinize Key Terms

- Your rights, responsibilities, and potential liability

- Mileage and geographic restrictions

- Fees if financing gets denied later

Request Final Loan Documents Upfront

- Completed loan application with verified personal details

- Formally approved interest rate and monthly payment

- Finalized loan length and down payment amount

- Lender name, contact information, and approval letter

If a dealer pushes back on providing these financing specifics upfront, they likely don’t have formal bank approval yet and hope to buy time with a bailment agreement.

Seek Legal Guidance

If any aspect of the bailment agreement seems concerning or confusing, don’t hesitate to show it to legal counsel. An hour of lawyer consultation upfront could save thousands down the road.

Alternatives to Accepting an Onerous Bailment Agreement

Rather than risking a dealer bait-and-switch or feeling trapped into bad financing terms later:

- Secure your own financing pre-approval – Apply directly with banks/credit unions so you know the exact approved rate and terms before entering negotiations.

- Wait to take delivery until after the dealer has all final loan documents from the bank firmly in place. Be persistent in requesting the paperwork.

- Put down a refundable deposit – Place a deposit to hold the vehicle for 1-2 days rather than taking immediate possession. Granting a short wait shouldn’t be an issue if the deal is legitimate.

- Walk away – If pressured to sign a concerning bailment agreement to drive home same-day, be willing to walk away. Quality vehicles and ethical dealers who honor original quotes do exist.

Key Takeaways: Should I Sign a Car Dealership Bailment Agreement?

- Bailment agreements allow temporary conditional vehicle transfers before financing approval

- Unethical dealers exploit them to bait-and-switch financing terms after possession

- Scrutinize terms, secure financing yourself, or wait for dealer loan approval

- Be ready to walk away rather than risk unconscionable terms later

Understanding dealership bailment agreements in detail allows you to navigate negotiations better. While they provide limited benefits in specific use cases, excessive restrictions or inability to provide concrete financing specifics should raise red flags.