In the world of used cars, knowledge is power. Whether you’re a first-time buyer or not, you should stay on top of what are possible red flags or signs of a scam when buying a car.

Mainly because they change, and that’s because the types of scams change.

My goal with this article with this article is to prepare you with the necessary information to avoid scams when buying a car from a dealership or private seller.

Relevant Articles to Read:

- What Kind of Lawyer Do You Need to Sue a Car Dealership

- Is it Illegal for a Dealership to Ask for a Down Payment

- Car Buying Scams

- Reason to Sue a Car Dealership

- Can I Sue a Dealership For Not Giving Me a Title

- Is It Illegal To Sell A Car Without Disclosing Problems

Table of Contents

Possible Red Flags or Signs of a Scam When Buying a Car

1. Unrealistically Low Price

If a deal seems too good to be true, it probably is. Although there is your occasional person moving for a job or a relative selling the car of a family member who has passed away an unrealistically low price is usually a sign of fraud or a vehicle with problems.

The most common type of scam I see related to cars with extremely low prices are people who are selling cars with a salvage title. Although a salvage car can be rebuilt, these cars are significantly lower in value and could potentially be unsafe.

TIP: Always compare prices from multiple sources and understand the market value of the car you’re interested in.

Another important read: How to spot and avoid Facebook Car Scams.

2. Rushed Sale

Sellers who are overly eager or pushy about closing the deal quickly may be trying to offload a problem vehicle. A legitimate seller will understand your need to think things over and have the car inspected.

3. Incomplete or Missing Paperwork

A vehicle’s history report and maintenance records are essential. If the seller can’t provide these, it’s a red flag. These documents provide valuable information about the car’s past and its upkeep.

See also: How you can Sell a Car Without Getting Scammed.

4. Tampered Odometer

Be wary of unusually low mileage for the car’s age. This could indicate odometer fraud, a scheme where the mileage is rolled back to increase the car’s selling price.

5. Seller Unwilling to Meet or Show the Car

These days it’s more common for people to be car shopping online, but If the seller is reluctant to meet in person or doesn’t want you to see or inspect the car, it’s probably a scam.

Always insist on seeing the car and having it inspected by a trusted mechanic.

6. Pressure to Pay Upfront

Never pay for a car without seeing it first. Scammers often pressure buyers to make upfront payments. Always use secure payment methods and avoid wire transfers.

7. The Car “Just Needs a Tune”

This phrase often masks underlying issues with the car. If a car “just needs a tune,” ask why the seller hasn’t done it themselves. It could be a sign of more serious problems.

8. Multiple Ownership Changes

Frequent changes in ownership could indicate problems with the car. A vehicle history report can provide this information.

9. Lack of Paperwork, Maintenance Records, Vehicle History

People who can’t seem to share with you any record of maintenance or vehicle history and are missing what seems like the common paperwork for a car could likely be trying to hide something.

However, in fairness, not everyone pays attention to details and keeps great records, so this is truly a red flag for a scam, but not necessarily a guarantee of one.

10. Suspicious Payment Methods

Avoid sellers who insist on payment methods such as wire transfers, prepaid gift cards, or cryptocurrency, because these can be difficult to trace and recover if you fall victim to a scam.

Legitimate sellers have no problem accepting more traditional payment methods, such as cash, certified checks, or financing through a reputable lender.

If a seller is adamant about using an unconventional payment method, it’s a major red flag that you should walk away from the deal.

11. Tampered or Inconsistent VIN Numbers

Scammers may try to tamper with or alter the VIN to conceal the vehicle’s true identity or history.

Before making any car purchase, cross-check the VIN on the vehicle with the VIN listed on the title and registration documents. If there are any discrepancies or signs of tampering, such as scratched or altered VIN plates, it’s a major red flag that the vehicle may be stolen or have a questionable history.

12. Sellers Story Doesn’t Make Sense

Sellers often provide a backstory or explanation for why they are selling the vehicle, and most buyers will ask for that unless its a dealer.

While some stories may be legitimate, be on the lookout of sellers whose stories seem inconsistent, implausible, or change over time.

For example, they may claim that they need to sell the car quickly due to a job relocation, a divorce, or a family emergency, but then at a later date you are told a different story.

Common Car Buying Scams

There are several types of scams out there that all car buyers should be aware of:

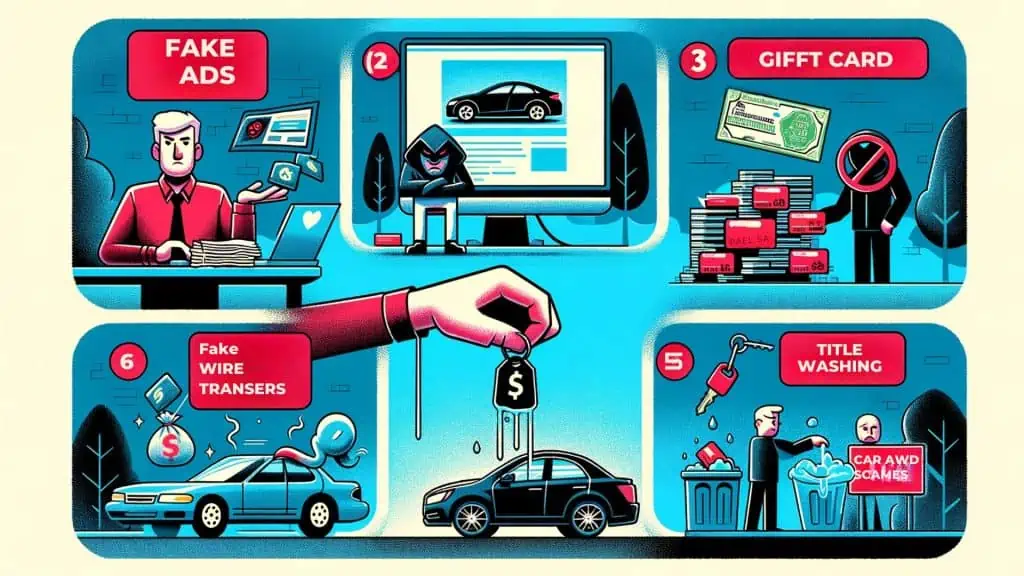

Fake Ads

Fraudsters often advertise cars that they don’t own. These ads may appear legitimate, displaying photos matching the description of the car and including contact details. To avoid this, ask for details about the car, such as the vehicle identification number (VIN), and insist on inspecting the car in person.

Gift Card Ripoffs

Some fraudsters insist on payment for a vehicle with gift cards. This is a clear red flag. Never purchase a car with gift cards as it is almost impossible to recover your money.

Fraudulent Wire Transfers

If a seller asks for money to be exchanged through a wire transfer, it’s best to decline. It can be difficult to recover your money if the deal turns out to be a scam.

Title Washing

Title Washing, which is a scam that involves hiding a car’s history, such as major damage from a wreck, by washing away critical information from the title. It’s illegal and often carried out in the sale of a used car. To avoid this, order a report that gives you a clear picture of the vehicle’s history before you buy it.

Curbstoning

A curbstoner sells used cars without holding the required license or permits and without maintaining a regular place of business. These fraudulent deals often happen in vacant parking lots, along the side of a road, or even at the curb in front of a home. Curbstoners typically sell salvaged or damaged cars to unsuspecting buyers and then disappear without providing any contact information.

Identity Theft

In this case, a scammer doesn’t care about buying your car. Instead, they’re interested in stealing your identity. They do this by requesting personal information such as bank account numbers, Social Security numbers, or car maintenance records. Be careful about supplying this type of personal data to anybody who says they’d like to purchase your car or accept a trade-in.

Fake Escrows

In this scam, a fraudster poses as a buyer and uses a fake escrow service to hold the money for a car purchase. After the seller turns over the car title, they quickly find out that the escrow money can’t be withdrawn. To prevent being scammed like this, pick a reputable escrow service that you want to use.

Payment Plans

A scammer may try to steal money by posing as a buyer and proposing car payments be made over time. The “buyer” may take possession of the car and make an initial payment or two but then stop.

When you’re the seller, your options for getting the rest of your money are limited. Don’t ever agree to a payment plan when you’re selling a car.

Remember, buying and selling cars online can be safe as long as you take the proper precautions to protect yourself.

Always do your research and trust your instincts. If something doesn’t feel right, it’s better to walk away from the deal.

How to Protect Yourself From Car Buying Scams

When buying a car, always do your research. Here are some steps you can take to avoid being a victim of a car buying scam:

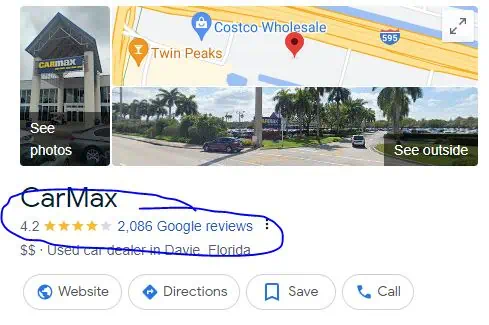

Verifying the Seller’s Identity

For private sellers, ask to see the registration, title, and I.D., then make sure the name matches ALL of the ownership documents and that they are up to date.

For dealers, check that you are dealing with someone that is reputable by searching the internet for reviews. Most legit dealerships will have reviews on YELP, Facebook, and Google.

Checking the Vehicle’s History Report

Trust but verify: A Carfax or an Autocheck report can give you all sorts of information about the history of a vehicle, however, it wont tell you everything. That said, what you’re going to do is cross reference what you find in the history with what the seller is claiming.

Getting a Pre-Purchase Inspection

Again, Trust but verify: Have a mechanic you trust or that is well reviewed online inspect the car and confirm that everything the seller stated is accurate.

Do this for dealers AND private sellers.

Examine Your Financing Documents

Some scams involve manipulating loan terms, including the interest rate, length of the loan, or the amount financed. Look over any loan terms received from a lender or dealer to make sure the numbers add up to what you have been promised BEFORE you sign.

Recognizing Online Scams

The biggest type of scam to look out for online are fake listings that request payment through crypto, wires, or fake escrow accounts.

These types of payment methods make it almost impossible to recoup your money, so stick to paying in person with a cashier’s check or through trusted escrow services offered by websites like Cargurus.

What to Do If You Spot a Red Flag

If you spot a red flag, NEVER ignore it. Ask the seller about it directly. If their explanation doesn’t satisfy you, walk away!

Remember, it’s better to miss out on a deal than to end up with a lemon.

What to Do If You’ve Been Scammed When Buying a Car

Discovering that you’ve been scammed when buying a car can be a distressing experience. However, there are steps you can take to rectify the situation and prevent further damage.

Report the Incident

Firstly, report the scam to your local law enforcement agency. While they may not be able to retrieve your money, they can investigate the incident and possibly prevent others from falling victim to the same scam.

Contact Your Bank

If you paid for the car using a credit card or bank transfer, contact your bank immediately. They may be able to stop the transaction or recover your money. If you used a credit card, you might be protected under your card issuer’s policies.

File a Complaint

File a complaint with your state’s attorney general’s office or consumer protection agency. They can provide advice and possibly take action against the scammer.

Consult a Lawyer

Consider consulting a lawyer, especially if a large sum of money is involved. They can advise you on your rights and possible legal recourse. If the amount is small, you might be able to take the case to small claims court and handle it yourself.

Check for Warranty or Service Contract

If your car comes with a warranty or service contract, read it carefully. You may be able to get some or all of your money back if the car doesn’t live up to the promises made in the warranty or contract.

However, chances are if the seller were running a scam, they wouldn’t offer a warranty to restore your purchase.

Even if they did,

Would they actually honor it?

Learn and Move On

While it’s a tough lesson to learn, use this experience to educate yourself about car-buying scams. Next time, you’ll be better prepared to spot red flags and avoid falling victim to a scam. Remember, if a deal seems too good to be true, it probably is.

Remember, it’s important to act quickly if you suspect you’ve been scammed. The sooner you take action, the better your chances of recovering your money and bringing the scammer to justice.

FAQ

How do I know if my car buyer is legitimate?

You should always verify the identity of anyone buying your car to know if they’re legitimate and not part of a scam. The first time you should verify the identity of a potential buyer is before they test drive your car. The next time will be to fill out the title.

What can scammers do with a vehicle’s VIN number?

With a VIN number, a scammer could register a vehicle, file claims on damaged/totaled cars, and even create spare/duplicate keys. I have even read about thieves who were able to create a fake registration and drive a car off of a dealer’s lot using the fake registration as proof of ownership.

Should I give a car buyer my VIN number?

Unfortunately, giving potential buyers your VIN number is an unavoidable part of the car-buying process. If you refuse, it will be perceived that you are hiding something and make it nearly impossible to sell your car.

Conclusion

It’s easy to get scammed and hard to avoid getting scammed, but I’ve covered enough above that you should avoid almost anything a fraudster might try to throw at you.

If you still have any questions, please feel free to leave them in the comments below!

A scammer will be looking for an easy target, so be difficult and ask for proof of everything. Most of the time they will lose interest in dealing with you in favor of an easier target.

Resources For This Article

- https://www.onpointcu.com/blog/how-to-spot-red-flags-when-buying-and-selling-vehicles-online-or-in-person/

- https://carexamer.com/blog/safe-tips-to-buy-new-used-car/

- https://www.thezebra.com/resources/driving/car-dealership-fraud/

- https://www.capitalone.com/cars/learn/finding-the-right-car/5-usedcar-red-flags-that-should-send-you-running/1752