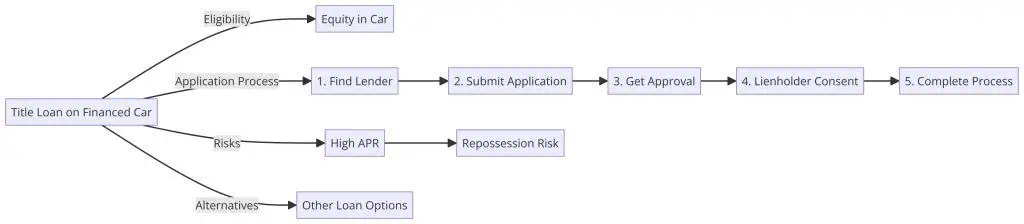

Yes, it is possible to get a title loan on a financed car in most states. However, the process can be complicated with risks to consider before moving forward.

Key Takeaways:

- You must have equity in the car to qualify for a loan. Equity is the difference between what you owe and the car’s value.

- Interest rates and fees are typically 200%+ APR, making loans expensive.

- Failing to repay could lead to repossession by either lender.

- Carefully weigh alternatives like lower-rate loans before deciding.

Whether you can actually obtain a title loan depends largely on the lender’s policies. Many lenders shy away from financed cars, but some advertise title loans for financed vehicles directly.

Table of Contents

How Does a Title Loan on a Financed Car Work?

With this type of loan, you use your car title as collateral to borrow money even though you have an outstanding auto loan balance. The title lender lends based on your available equity.

For example, if you owe $8,000 on a car worth $12,000, you have $4,000 in equity. A title lender may offer a loan up to a percentage of that amount.

Related Articles To Read:

- Can You Get a Title on a Car That Is Not Paid Off

- What Disqualifies an Applicant For a Title Loan

- What Is Title Pawning And How Does It Work

- Title Loan Loopholes – How To Get Out Of A Title Loan

- What Happens If You Default on a Title Loan?

Eligibility Requirements Vary By Lender

While requirements fluctuate, common criteria include:

- Equity – Most lenders require 20-50% equity to qualify. Some may approve less.

- Income – Proof of income is typically mandatory. Actual thresholds depend on the lender.

- Vehicle inspection – The lender will assess your car’s make, model, age, condition and mileage. Luxury vehicles often yield higher loans.

You’ll also need to provide proof of identity and insurance documentation in most cases.

The Loan Application Process

Applying for a title loan on a financed vehicle involves a few extra steps compared to an owned-outright car:

- Find a willing lender – Many lenders avoid financed cars, so finding one is critical first step.

- Submit application – Provide all required paperwork on identity, income, vehicle details etc.

- Get approval – The lender reviews your application and proposes loan terms.

- Lienholder consent – The lender must get consent from your original auto lender to secure a secondary loan.

- Complete loan process – Once approved, finish paperwork and receive your payout.

Be prepared to pay origination fees too. It’s key to ask lenders upfront if they finance cars with existing liens to avoid wasted applications.

Consider the Risks Before Borrowing on a Financed Car

While enticing for quick cash access, title loans on financed vehicles carry major downsides, including:

- High costs – Interest rates often exceed 200% APR when fees are included. This makes loans expensive to pay off.

- Tough to budget – The monthly loan payment is added on top of existing car payments.

- Potential repossession – If you default, either lender can take back the car.

- Hurts credit – Missing payments results in a negative credit bureau report.

Alternatives May Better Serve Your Needs

Before resorting to a title loan, exhaust other, less risky borrowing options:

- Personal loans – Banks and credit unions offer installment loans at lower rates.

- Refinancing – You may qualify to refinance your current auto loan at a lower rate.

- Hardship programs – Your lender may offer temporary relief options if you cannot pay.

- Credit counseling – Non-profit agencies provide advice on improving your finances.

Only pursue a title loan on your financed vehicle as your last choice. And if you do, read all fine print to understand potential consequences before signing anything.