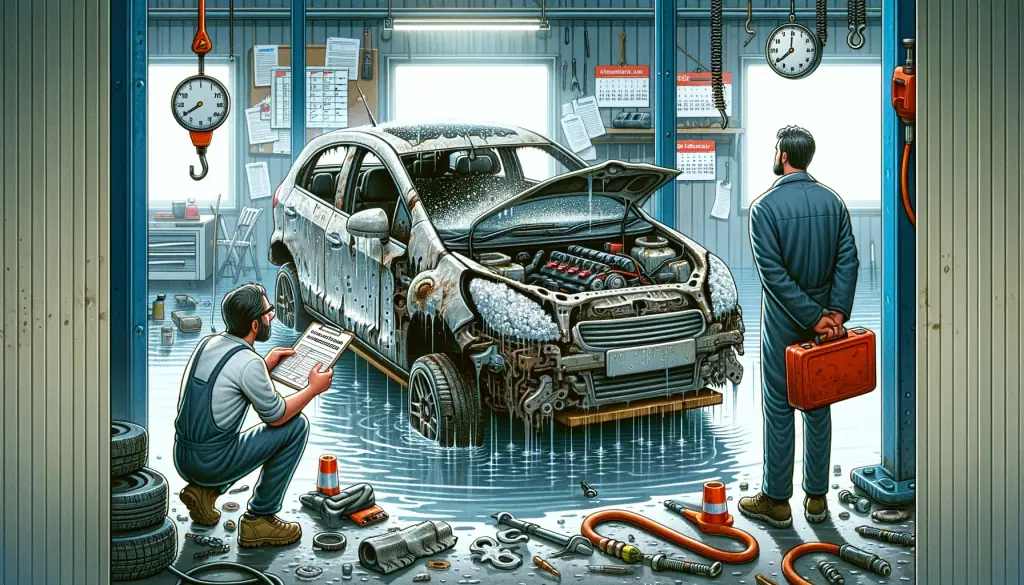

Flood damaged cars can cause major headaches for both buyers and sellers.

As an ex-car dealer, I’ve seen these water-logged vehicles first and want to guide you on spotting, avoiding, and properly handling them.

In the aftermath of massive storms, over 452,000 flood cars were already on US roads in 2023, with numbers rising sharply following hurricanes and floods.

Flood damage can lead to immediate problems or cause issues years later as corrosion sets in. That’s why education is key to protecting yourself from the risks of buying or selling flood cars.

Key Takeaways

- Flood-damaged cars can pose immediate dangers or problems years later through corrosion

- Signs like mud/rust indicate water intrusion – have a mechanic thoroughly inspect

- Insurers typically declare flooded cars total losses due to high repair costs

- State-issued branded titles disclose flood history – but title-washing scams exist

- Use vehicle history reports and meticulous inspections before any used car purchase

- Sellers must fully disclose flood damage and repair history legally

Table of Contents

How To Check For Flood Damage On a Car

The first critical step is detecting water damage before it’s too late. Here are the top signs to inspect for when checking any used car:

- Moldy or musty odors in the cabin or vent system hints at past flooding. Sellers may try masking smells with cleaners or “new car” scent sprays.

- Sand, silt, or mud caked into carpets, under seats, inside the glove box or trunk can be evidence of water exposure.

- Check for discolored, stained, or mismatched interior pieces like floor mats and upholstery.

- Rust around doors, on pedals, or under the dash shouldn’t be there on newer cars.

- Foggy headlights/taillights or moisture beads inside could indicate the lighting housings took an underwater trip.

- Flooding can damage sensitive electronics and wiring over time. Test all accessories thoroughly.

Water damage may be obvious initially or take months to manifest. Don’t take any chances. Have a certified mechanic thoroughly inspect the flood car suspect, even if no issues appear on the test drive.

Dangers of Buying and Driving Flood Vehicles

It’s risky to purchase a flood-damaged car even if it is repaired, cleaned, and disclosed properly. Why take a gamble when water can wreak extensive havoc?

Potential problems include:

- Electrical shorts and corrosion on ECUs, wiring, lights

- Engine and transmission failure from contaminated lubricants

- ABS/traction control malfunctions

- Airbag system damage poses extreme safety hazards

- Mold/mildew health issues

- Reconditioning costs could outweigh the used car’s value

Additionally, insurers may deny collision or comprehensive coverage for salvage-titled flood cars. Without that protection, owners pay for repairs out of pocket.

I’ve also seen flood car electrical gremlins take months or years to surface. Save yourself the headaches and walk away.

Key Figures on Flood Damaged Vehicles

Hurricanes and storms flood hundreds of thousands of cars each year.

This table shows important numbers on how many water damaged vehicles get back on the road – proving all used car buyers must stay alert across the country.

| Statistic | Figure |

|---|---|

| Flood cars currently on US roads | 452,000 |

| Annual increase in flood cars (2021-2022) | 6% |

| Additional cars flooded by Hurricane Ian | 358,000 |

| Vehicles damaged by Hurricane Ida | 212,000 |

| State with most flood cars | Texas (98,400) |

| State with 2nd most flood cars | Florida (34,000) |

| Flood cars in Houston metro area | 32,000 |

| Flood cars in New York City metro | 25,000 |

| Flood cars in Miami/Ft. Lauderdale metro | 19,000 |

| Flood cars in Philadelphia metro | 18,600 |

| Flood cars in Ft. Myers/Naples metro | 14,700 |

| Flood cars in Lexington, KY metro | 13,000 |

| Flood cars in Dallas/Ft. Worth metro | 12,400 |

| Flood cars in Chicago metro | 11,700 |

| Flood cars in Tampa/St. Pete metro | 9,500 |

| Flood cars in Minneapolis/St. Paul metro | 8,600 |

What To Do If Your Car Floods

If your car gets swamped, quick action is vital to reduce damage:

- File an insurance claim ASAP – Provide photos/video documenting the incident

- Don’t start the flooded engine – Further damage could occur

- Have the car towed to higher ground for drying/inspection

- Vacuum water from carpets/seats, use towels to absorption moisture

- Run dehumidifiers or fans to accelerate interior drying

In many cases, the repair estimate will exceed your vehicle’s cash value. Prepare for the insurance company to declare it a total loss.

Is a Flood Damaged Car Repairable?

Determining if a flooded car can be cost-effectively repaired depends on multiple factors:

- Minor freshwater flooding that’s promptly drained may allow for repairs, while cars left in feet of water for days often become unsalvageable.

- Saltwater causes rapid corrosion – making successful restoration unlikely if submerged in ocean floodwaters.

- Repairs easily cost $12,000+ – exceeding many used cars’ cash value. Facing sky-high estimates, most insurers total flood vehicles.

- Even fixed flood cars can develop mechanical issues or health hazards like mold over time. It’s difficult to restore them to permanent pre-incident conditions.

- An expert mechanic should thoroughly assess all components to determine viable repair options accounting for immediate work plus likely future problems.

- While revived flood cars may legally get rebuilt titles and registrations after repairs, they present ongoing ownership risks – from inflated maintenance budgets to refused insurance claims.

In my professional opinion, extensive flood reconstruction is rarely worthwhile for consumers.

Between steep initial quotes and inevitable post-repair headaches, writing these cars off as total losses often proves the best option long-term.

Of course, exceptions exist, like precious classics or rare models.

Absent those unique cases, avoid buying even “fixed” flood cars if aiming to contain costs and headaches.

Does Insurance Cover a Flood Damage Car?

Yes, but only if you have comprehensive coverage on your auto insurance policy. Comprehensive insurance pays to repair or replace your car if it’s damaged by flooding.

Key points:

- Comprehensive auto insurance covers damage to your car from freshwater or saltwater flooding. This includes being fully submerged.

- File a claim right away after flood damage. Provide photos/videos and be patient, as claims may take longer after major disasters.

- Insurers quickly assess flood damage. If fixing the car costs more than it’s worth, it’s usually declared a total loss, especially with interior flooding.

- If your car is totaled, the insurer pays the actual cash value minus your deductible. This is often less than what you owe if you have a car loan. Consider gap insurance.

- You can negotiate the settlement or justify a higher value if you think your car is worth more than the insurer’s offer.

State Branded Titles: What They Mean

Branded titles are required in most states for flood-damaged cars:

- Salvage – Deemed total loss by insurer after taking an underwater trip or other major damage

- Flood – Special designation in some states for water damage history

- Rebuilt – Repairs were made, allowing registration after passing the inspection

Branded titles stay with cars for life, warning prospective buyers. But shady sellers have been known to “wash” titles to hide damage history.

Always get a vehicle history report from NMVTIS-approved sources and check titles yourself before buying used.

Guidance for Selling Flood Vehicles

If offering a flood car for sale, ethical practices are mandatory. Here are key steps:

- Have all repairs completed and retain service records

- Obtain a rebuilt/salvage title per your state’s regulations

- List flood history and title brand prominently in all ads

- Be upfront upon showing and answering buyer questions

- Provide vehicle history reports verifying flood exposure

Attempting to sell secretly without disclosing flood damage violates state consumer protection laws. Additionally, transferring a clean title could constitute odometer fraud. Don’t put yourself at legal risk.

Protecting Used Car Buyers

Stay vigilant when shopping for used cars after disasters strike flooded areas. Here’s how to avoid surprises:

- Research the car’s origins – See if previous registration matches storm zones

- Check all IDs match the seller (title, registration, insurance cards, etc)

- Get an NMVTIS vehicle history report from a reputable provider

- Inspect titles yourself for Salvage/Flood brands before buying

- Have your mechanic do a thorough pre-purchase inspection

- Walk away if anything seems inconsistent or suspicious

I’ve seen dozens of consumers taken advantage of after hurricanes. It pays to be cautious – it is better to pass on a deal than regret it later.

My Final Thoughts on Flood Damaged Cars

In my experience, flood cars rarely get fixed correctly.

As buyers or sellers, we need to stay informed and exercise caution in these situations.

I hope this overview better equips you to make the smartest decisions for your unique circumstances. Let me know if you have any other flood car questions!

Sources and References:

- https://www.junkcarmedics.com/blog/are-flood-damaged-cars-repairable/

- https://www.tdi.texas.gov/tips/car-flooded.html

- https://www.consumerreports.org/money/car-insurance/why-flooded-out-cars-are-likely-total-losses-a9926753411/

- https://www.nicb.org/news/blog/damaged-vehicles-flooding-used-car-market

- https://www.prnewswire.com/news-releases/carfax-as-many-as-212-000-vehicles-damaged-by-hurricane-ida-301378725.html

- https://www.nhtsa.gov/hurricane-and-flood-damaged-vehicles

- https://auto.howstuffworks.com/under-the-hood/salvage-used-junkyard-parts/10-ways-to-spot-flood-damaged-car.htm

- https://www.abc10.com/article/news/local/auto-expert-water-damage-car/103-639fa3e9-9834-4c47-a51e-8cd925559166

- https://www.northeastacura.com/10-ways-to-spot-a-water-damaged-vehicle