If you found this article, you have probably missed a few payments on your cars title loan and are curious how late can you be on a title loan before they take your car.

Short Answer:

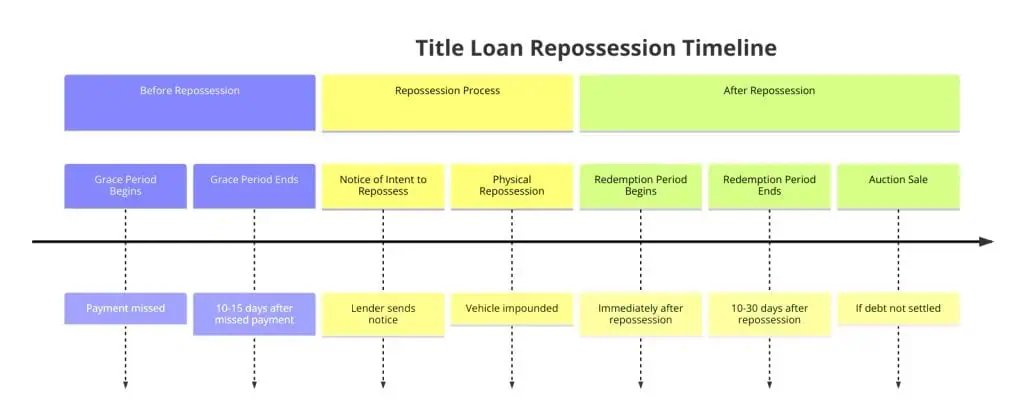

If you miss or are late on payments for your car title loan, the lender can legally repossess your vehicle immediately, but, you typically have at least a 10-15 day grace period after a missed payment before repossession begins.

This timeline varies, so stay in close contact with your lender if you are struggling to pay.

That said, most title lenders understand hardships happen and will try to work with borrowers before taking your car.

Table of Contents

Related Articles To Read:

- Can a Title Loan Company Sue You

- Bankruptcy vs. Car Repossession: Which Is Worse

- Title Loan Loopholes – How To Get Out Of A Title Loan

- How To Sell A Car With A Title Loan

- What Happens If You Default on a Title Loan?

- What Is Title Pawning, And How Does It Work

- Can I file For Bankruptcy And Keep My Car

Do Title Lenders Really Want to Repossess Your Car?

Contrary to popular belief, repossession is an absolute last resort for lenders. It requires considerable time and money on their end to legally seize and sell vehicles at auctions.

Most title loan companies would much rather find an alternative solution, such as:

- Allowing more time to pay with an amended contract

- Lowering monthly payments temporarily

- Refinancing existing loan terms

As long as you communicate openly about repayment issues, there is a good chance options besides repossession will be offered.

State Laws and Timeline Before Title Loan Repossession

Each state has its own regulations regarding how many days past due a title loan must be before the repossession process can begin legally:

- 10 states have no set minimum grace period before repossession once payments are missed

- The most common timeline is 30 days past due

- Some states range from 10 to 60 days overdue before lenders can take vehicles

- A few states prohibit title lending altogether

Check your original loan agreement for details on the grace period policies in your state and from your specific lender. Be aware that additional late fees often apply once this window ends.

Getting Your Car Back: Redemption Period After Repossession

If efforts to avoid falling behind fail and your vehicle gets repossessed, most states have a post-repossession redemption period where borrowers can still get their cars back.

This involves paying the total loan balance and any additional repossession/auction fees the lender incurred in many cases.

Typical state redemption period timelines are:

- 10 days

- 15 days

- 30 days

Again, confirm your rights and timeline to redeem your title by checking state regulations and your loan contract. Acting quickly gives the best chance of recovering your repossessed vehicle without further hassle.

Key Steps to Avoid Title Loan Repossession

- Prioritize payments above other expenses each month

- Reach out to the lender as soon as possible if you anticipate issues making payments

- Ask about options to refinance terms or temporarily reduce payments

- Read your entire loan contract to understand the repossession process timeline

- Utilize state redemption period rights if the vehicle gets repossessed

Following these best practices helps prevent title loan default. But if you do fall behind on payments, constant communication and good faith efforts give the best shot at protecting your vehicle ownership despite hardship.

Now that you know what happens if you default and how lenders approach late payments, let’s examine the step-by-step repossession process most states follow.

Overview of the Title Loan Repossession Process

When borrowers are extremely late on payments, lenders have the legal right to take possession of vehicles used to secure loans. Repossession procedures adhere to strict state guidelines. Here is what typically transpires:

Initial Notice of Intent to Repossess

Lenders send registered letters indicating they plan to repossess collateral vehicles on a specified date if the default is not resolved beforehand. This serves as official notice to pursue legal action to recover losses.

Using a Licensed Recovery Agent

Repossession agents must hold state licenses granting them the power to seize property legally per a contract’s terms. Lenders hire these professionals once initial notices expire without a response.

Temporary Vehicle Impound Holding Period

After physical repossession, cars sit at contracted impound lots for 7-15 days on average. This provides a final opportunity for you to redeem vehicles before permanent loss.

Auction Sale and Deficiency Notices

If no plan to become current on payments results from last-ditch outreach, lenders auction cars to attempt to recover losses.

Any proceeds insufficient to satisfy loan balances lead to further notices demanding additional payments from borrowers.

In summary, falling severely behind on title loan payments sets off a direct chain reaction where your vehicle serves as collateral.

Avoid this worst-case scenario through open communication and prioritizing payments whenever possible.

Refinancing and Other Payment Alternatives

Refinancing an existing title loan involves paying off the old contract and entering a new agreement with better terms.

But qualifying with the same or a new lender requires being current on existing payments in most cases.

Other options like credit counseling services can help negotiate with creditors as well. Tapping friends/family, credit cards, pay advances, or consolidation loans offer additional ways to catch up if facing repossession due to title loan default.

What To Do If Your Vehicle Gets Repossessed

Losing your car to repossession leads to a complicated situation:

- You lose reliable transportation critical for work and life

- Lenders sell vehicles quickly at auction for maximum value

- Outstanding loan balances still owed require payment

- Significant damage to your credit standing occurs

If efforts to avoid default prove unsuccessful, focus on redeeming the vehicle ASAP once it is taken. This means paying the repossession company or lender exactly what they require to settle the debt. Inquire about minimum release amounts and whether personal references or co-signers might help.