As a former car dealer, I occasionally had to help people transfer a car title out of a trust, usually to sell the car to us at the dealership.

Whether you are a trustee looking to distribute assets to beneficiaries or want to remove a car from a trust for other reasons, the process can seem complicated, but it really isn’t.

The guide I created below is designed to help streamline the process of transferring a car title out of a trust for you. If you have any questions that I didn’t answer, just leave a comment at the bottom of the page.

Table of Contents

Relevant Articles To Read:

- How to Transfer a Car Title After Death of Owner

- How Much Is Gift Tax On a Car

- How to Transfer A Car Title To A Family Member

- Can You Donate a Car Without A Title

- Can You Add Someone To A Car Title?

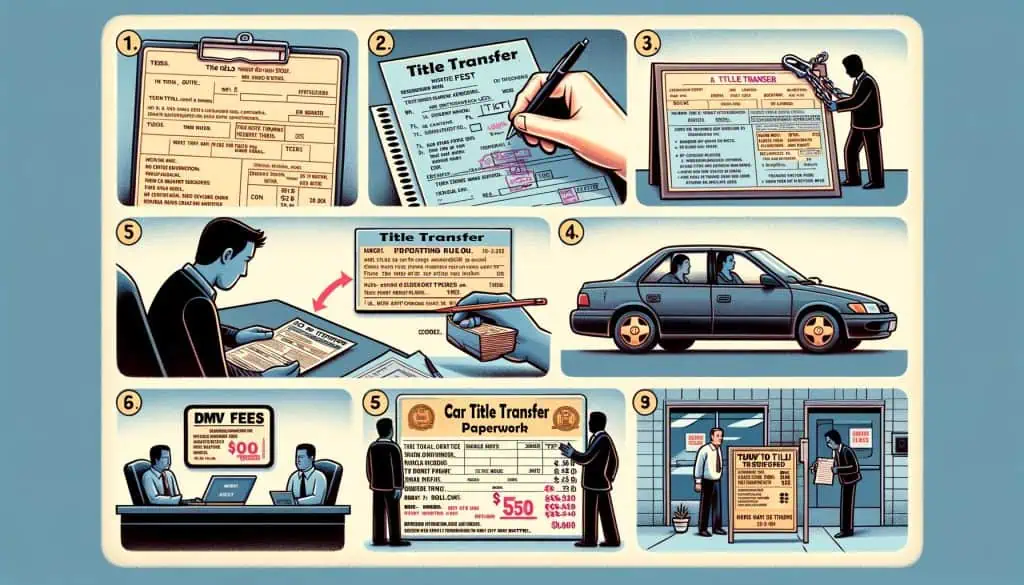

Steps To Transfer A Vehicle Title From A Trust

Follow these key steps to successfully change ownership from a trust:

1. Choose The New Owner

Decide who will take over the car. Often trustees transfer vehicles to trust beneficiaries. But cars can also go to third parties if allowed by the trust terms.

2. Gather Necessary Documentation

To prove you have authority and ownership, compile:

- The original title listing the trust as the owner

- Trust documents showing the trustee’s powers

- Odometer statement if under 10 years old

- DMV forms – varies by state

3. Complete The Car Title Transfer Paperwork

Fill out your state’s title transfer forms correctly:

- Mark the trust as the seller, with trustee signing

- Indicate the new owner’s name as buyer

- Include sales price and odometer reading

4. Pay Applicable DMV Fees

Each state sets their own title transfer fees. Budget around $50 per car in most states.

5. File Completed Documents With The DMV

Submit paperwork to your local DMV office for processing. After verification, they will issue a new title under the new owner’s name.

How Do You Sell a Car That is in a Trust?

When it comes to selling a car owned by a trust, the process varies depending on whether the trust is revocable or irrevocable.

Understanding these differences is important for trustees when selling a trust asset. Here’s what you need to know:

Sellin a Car From a Revocable Living Trust

A revocable living trust offers a relatively straightforward process for selling a car. The table below outlines the essential steps:

| Step | Action | Description |

|---|---|---|

| 1 | Verify Trust Provisions | Review the trust document to confirm your authority as the trustee to sell the car. |

| 2 | Prepare Title Transfer | Fill out the vehicle title’s transfer section with the buyer’s details and sign as the trustee. |

| 3 | Provide Supporting Documents | Supply the buyer with a copy of the trust document or a certification of trust, plus the signed title. |

| 4 | Buyer Completes Transfer | The buyer will take these documents to the DMV to finalize the transfer and register the car in their name. |

Selling a Car From an Irrevocable Trust

Selling a car from an irrevocable trust involves more complexity, often requiring approval from parties involved with the trust. The steps are outlined in the table below:

| Step | Action | Description |

|---|---|---|

| 1 | Review Trust Terms | Examine the trust document for any provisions regarding the sale of assets and your authority as trustee. |

| 2 | Obtain Approval if Needed | Depending on the trust terms, seek approval from the grantor, beneficiaries, or a court. |

| 3 | Prepare Title Transfer | Complete the title transfer section as for a revocable trust, signing as trustee. |

| 4 | Provide Supporting Documents | Hand over to the buyer the trust document, evidence of your trustee status, and any other required proof of authority. |

| 5 | Buyer Completes Transfer | The buyer proceeds to the DMV with the provided documents to complete the ownership transfer. |

Important: In both scenarios, trustees must act in the best interest of the trust, ensuring the car is sold at fair market value and adhering to their fiduciary duty.

If you wish to give the car to a family member, you should research gifting a car to a family member rather than selling it.

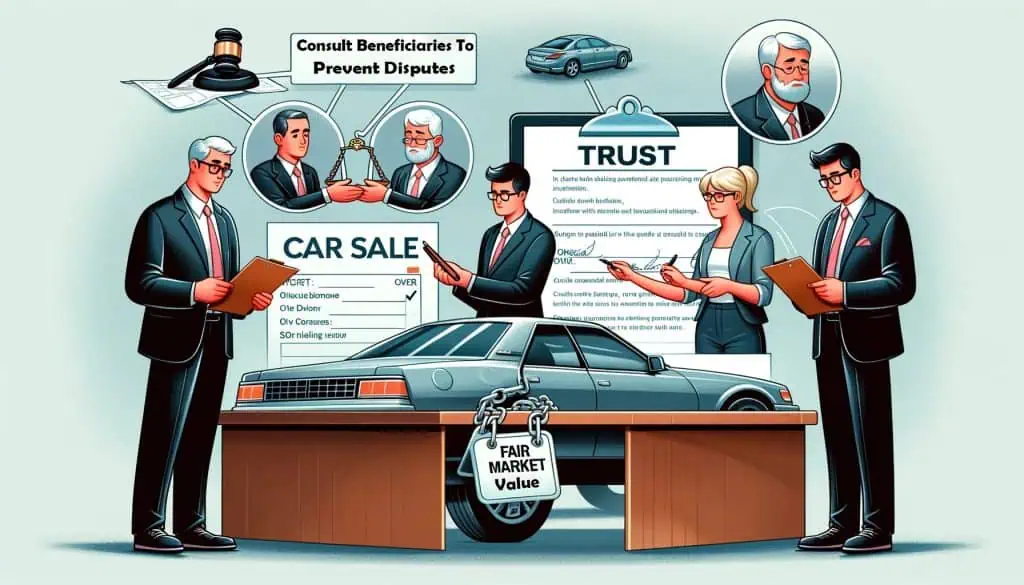

Consulting with an estate attorney is generally recommended when selling significant trust assets to effectively navigate any legal complexities.

Can You Sell A Car From A Trust Without Transferring Ownership?

Beneficiaries often ask if they need to transfer a car to their name before selling it out of a trust. The good news is you can sell trust vehicles directly without titling it personally first.

- Trustees handle sales, but beneficiaries can demand assets be liquidated and receive proceeds.

- Trustees can sell without explicit consent, but should consult beneficiaries to prevent disputes.

- To sell the car, the trustee signs over title on behalf of the trust.

- Trustees must sell at fair market value to avoid breaching fiduciary duties.

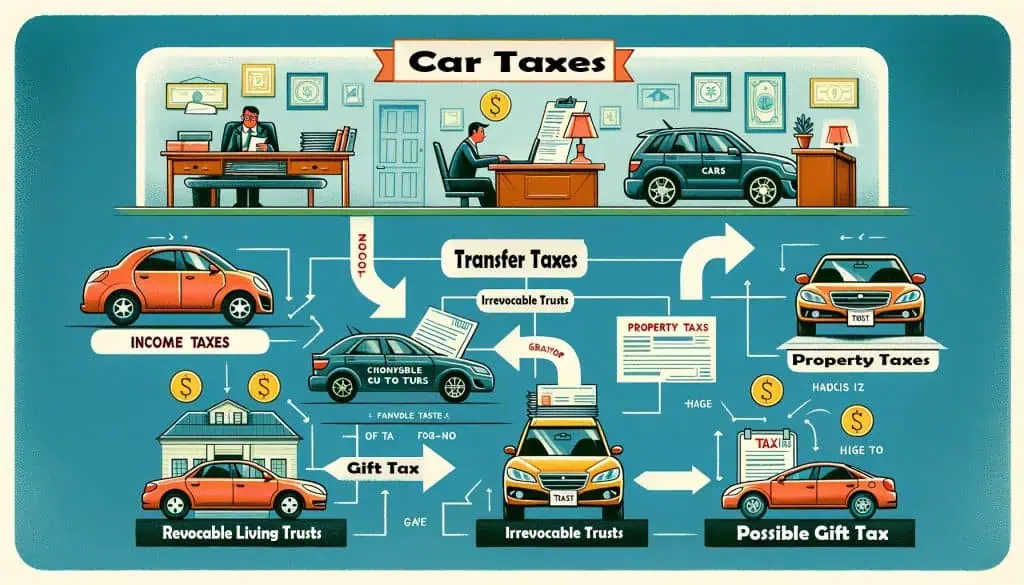

How Does Transferring To A Trust Affect Car Taxes?

Many wonder if putting vehicles into trusts changes their tax obligations. Here is an overview of impacts by type:

Income Taxes

- For revocable living trusts, no change – grantors still report income personally.

- Irrevocable trusts may owe income taxes on earnings from vehicles they hold.

Property Taxes

- Most states don’t alter property taxes on cars in revocable trusts.

- Florida could assess higher property taxes.

- Irrevocable trusts may trigger increased property taxes.

Transfer Taxes

- No gift/estate tax putting cars into revocable trusts since the grantor retains control.

- Transferring the vehicle to an irrevocable trust could create a gift tax if it is over annual exclusion.

In most cases, revocable living trusts do not create tax obligations on vehicles.

However, those with irrevocable trusts should consult a tax professional to understand possible impacts. Reach out with any other questions!

Key Considerations When Transferring From Trusts

Be aware of these potential issues when moving vehicles out of trust ownership:

1. Insurance Changes

Insurance can cost more under a trust. Shop policies when transferring title.

2. Limited Window For Transfer

In irrevocable trusts, trustees may have a deadline for asset distribution.

While trusts provide excellent benefits for managing cars, factors like insurance, taxes, and distribution timing should be evaluated when opting to transfer title out of trusts. Certain states also have specific laws governing trust vehicles.

Sources For this Article:

- https://legalbeagle.com/12718909-how-to-remove-a-vehicle-from-a-family-trust.html

- https://www.trustate.com/post/how-to-sell-a-car-directly-from-an-estate

- https://www.linslawgroup.com/blog/2022/11/should-i-title-my-vehicles-in-my-revocable-trust/

- https://legalees.com/cars-into-living-revocable-trust/

- https://www.legalzoom.com/articles/transferring-assets-into-a-living-trust-can-you-do-it-yourself

- https://www.nwitimes.com/business/local/dont-forget-put-the-car-in-the-trust/article_1d606c01-1c9f-5190-907d-c7d8eb7473bd.html

Legal Disclaimer: This article provides general information about transferring car titles from trusts. The information is not intended as legal advice tailored for any specific situation or individual circumstances. For personalized guidance regarding your unique situation and the laws of your jurisdiction, consult with a licensed attorney or appropriate professional before taking any actions related to transferring vehicle titles or amending trusts.