Purchasing a vehicle can be an exciting milestone in a teenager’s life. However, there are important legal and financial considerations for teens and parents when buying a car under 18. This guide covers age requirements, financing, insurance, titling, and more.

Important Related Articles to Read:

- Can You Buy a Car With a Permit

- How to Use Your Income Tax Return to Buy a Car

- How Old Do You Have to Be to Rent a Car on Turo

Table of Contents

Legal Age to Purchase a Car

In most states, there is no age at which you are not allowed to buy or own a car; however, when it comes to financing, insuring, and registering a car, that’s where a minor will likely encounter issues.

The issue here is that minors are not legally capable of entering into a contract, which is something you must do if you are financing a vehicle, or obtaining insurance to get it registered.

Can a 16 Year Old Own a Car?

Through my research, the simple answer is yes, you can own a car at 16 years old. Only one state puts limitations on a 16-year-old owning or being able to buy a car: Washington State (See details below).

However, to legally drive any car, you will need insurance and registration, which is where there could be some requirements to be 18, but this will depend on what state you live in and who your insurance provider is.

All that being said, don’t worry because in most states, you can usually list a parent as a co-owner or a 16-year-old as a driver to comply with both insurance and state law.

Washington state only allows 16 and 17-year-olds to own a car if they previously owned a car in another state. The option does exist to add a 16 or 17 year old as a driver to legally drive the car, but ownership is not possible until 18 years old.

Dealership Purchases

Most dealerships require buyers to be at least 18 years old or have a parent/guardian co-sign the sales contract. Some states, like Wisconsin, allow minors to enter contracts for vehicle purchases if a parent agrees to take liability.

Private Sales

While private party sales may have more flexible age requirements, lenders often will not provide financing to minors unless they have a co-signer. Minors may also have difficulty properly registering and titling the car without adult involvement as I mentioned earlier.

Financing Options for Teen Drivers

Financing from traditional lenders usually requires borrowers to be at least 18 years old. Here are some potential options for teens to pay for a car:

- Savings – Paying in full with cash upfront

- Parent/Guardian Co-signer – Co-signer agrees to be responsible for loan terms

- Buy Here Pay Here Dealerships – Higher interest rates but may work with limited credit

- Peer-to-Peer Lending – Borrow from individuals instead of institutions

When applying for financing, minors should have a co-signer and provide proof of regular income. Building credit beforehand can help teens qualify for better rates.

Insurance Companies That Insure Minors 16 years old

I searched and found a few insurance companies that will insure drivers under 18 years old, here they are:

- Progressive

- Geico

- State Farm

- USAA

*It’s important to remember that although these insurers will cover a 16-year-old driver, they might require they be added to the parent’s policy. If you are able to insure a 16-year-old individually, that policy will be very expensive.

Insurance Requirements for Minors

Liability insurance is required for all drivers. Most insurers prefer drivers to be at least 16 years old and licensed. To get teen drivers coverage:

- Add them to the parent’s policy as a named insured

- Consider pricing from multiple carriers

- Ask about discounts for good students and driver’s education

Exceptions for Emancipated Minors

While most states require car buyers to be 18, emancipated minors can purchase vehicles in their own name earlier:

- Emancipated minors are legally responsible for themselves before age 18

- Ways to become emancipated:

- Enlisting in the military (requires parental consent)

- Getting married (requires parental consent in most states)

- Receiving a court order

- Once emancipated:

- Can enter legal contracts like auto loans

- Allowed to title and register vehicles themselves

Insurance Cost-Saving Tips for Teens

Car insurance for teen drivers is expensive due to higher risk. Here are tips to minimize costs:

- Add teen to parent’s policy vs. separate policy

- Often cheaper to have on parent policy until 18+

- Ask about good student and driver’s ed discounts

- Can save up to 15-25%

- Consider pricing from multiple carriers

- Compare quotes every renewal period

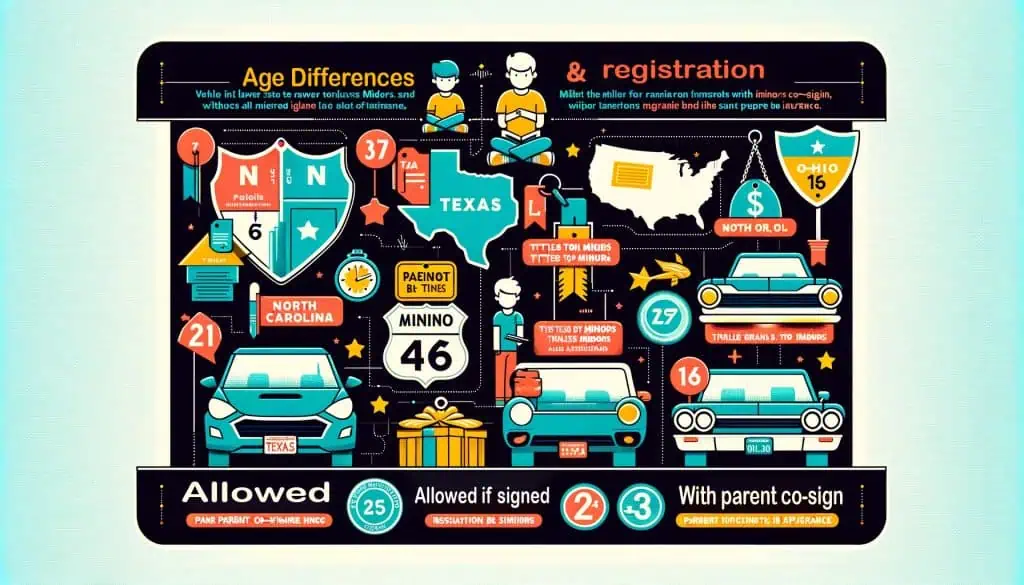

State-Specific Age Differences

Laws around titling and registration have some variation state to state and below are some examples:

| State | Title Transfers to Minors | Registration by Minors |

|---|---|---|

| Texas | Allowed | Allowed |

| North Carolina | Allowed if signed | Not without insurance |

| Ohio | With parent co-sign | Parent must be present |

Check with your local DMV for specific laws in your state.

My Final Guidance for Parents of Teen Drivers

- Help explore insurance and financing options

- Co-sign loan and sales documents if needed

- Consider holding the title yourself until adulthood

- Set ground rules and boundaries for driving privileges

- Lead by example with safe driving habits