As a former used car dealer, I occasionally found myself involved in car repossession, either directly or indirectly.

Considering all of the legal confusion on the topic, and it’s importance to people who find themselves behind on car payments, I created this article to answer a few important questions related to the actual authority a repo agent has.

Lets start with the key points:

Key Repossession Guidelines

- Agents may enter unlocked private areas without permission

- Owners can withdraw consent, forcing agents to leave immediately

- Only some states make pre-seizure notices mandatory

- Illegally handling other vehicles risks complaints and lawsuits against the agent

Below, I outline my findings in detail to equip the public and professionals on compliant collateral recoveries

Related Articles To Read:

- The Complete Guide to Car Repossession

- What Happens If You Hide Your Car From Repossession

- What Time Do Repo Men Usually Come

- Give Back Car – Avoid Repossession

- Car Repossession Laws By State

- Can I file For Bankruptcy And Keep My Car

Table of Contents

Can a Repo Man Move Other Cars to Get To Mine?

Yes, they can; laws don’t explicitly prohibit repo men from temporarily moving unrelated vehicles to access your car.

Yet mishandling still risks complaints and litigation.

If cars suffer damage during relocations, owners can pursue the financing dealer for injury compensation, and they will win.

Risk Examples:

- Scuffing vehicles while shifting them for access

- Accidentally knocking cars into each other

- Draining batteries by leaving cars unlocked

While rare, these collateral mishaps still expose my business to severe penalties without firm legal protection. Thus strict liability standards must coach agents on precautions.

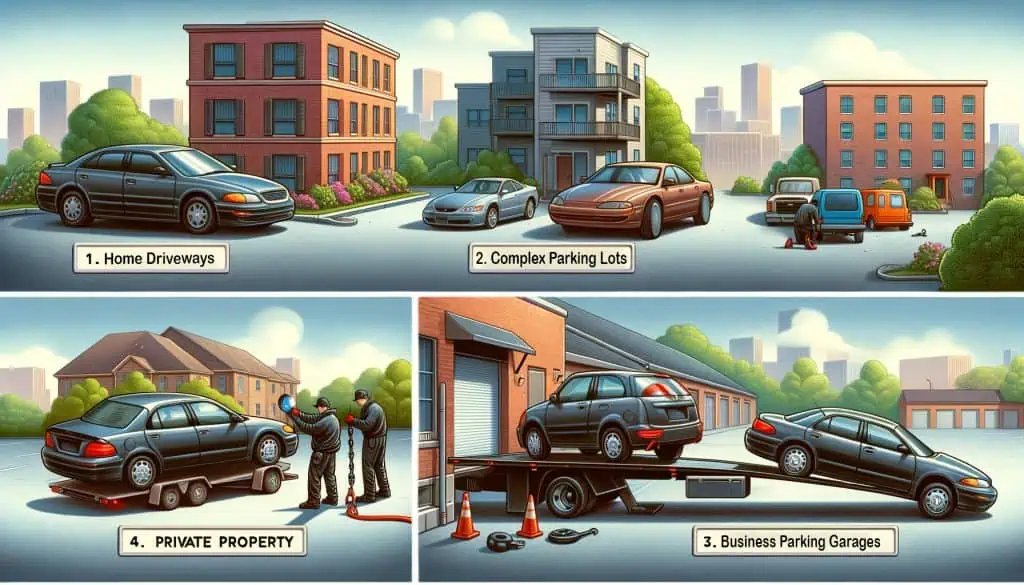

Can you Repo a Car On Private Property?

Yes, in most states, like Pennsylvania, Florida, etc., repo agents freely access unsecured private property zones like driveways to seize assets after defaults without breaching peace charges.

Permitted Access Examples:

- Apartment complex parking lots

- Home driveways

- Business parking garages

Can a Repo Man Open My Garage?

No, repo agents cannot damage barriers or enter restricted areas like locked garages without explicit permission, even with a court order.

Owners must willingly assist entry. Otherwise, forced access risks breach of peace fines or criminal charges forrepo companies and financing dealers alike.

Managing Owner Objections

If owners confront access attempts, they can legally revoke assumed permission and order agents off the premises. Ignoring these objections breaks consumer protection laws.

| Legal Objection Statements | Agent Requirement | Consequences of Violation |

|---|---|---|

| “I told you to stop and leave my property” | Must immediately halt process and depart location | Breach of peace penalties |

| “I deny consent to take my vehicle” | Cannot continue repossession effort | Lawsuits funded by financing dealers |

As the financing dealer, it’s my responsibility to ensure agents respect revocations, avoiding disputes and lawsuits.

Notice Requirements

In most states, agents fulfill orders without pre-seizing notices as surprise timing provides advantages.

However, select areas mandate confirmation letters mailed to debtors within so many days after asset transfers outlining resulting financial obligations.

Checking regional norms is crucial before presuming appropriate protocols.

Pre-Seizure Notification Norms

Although most states allow unannounced vehicle seizures, select regions protect consumers with mandatory repossession notices.

See this Quick Reference Table For Repossession Laws State by State

Right to Cure Notice States

| State | Notice Type | Notice Window | Cure Requirement |

|---|---|---|---|

| Iowa | Right to Cure | 20 days | Become current on payments |

| Kansas | Right to Cure | 10 days | Become current on payments |

| Maine | Right to Cure | 20 days | Become current on payments |

| New Hampshire | Right to Cure | 20 days | Become current on payments |

| New Jersey | Right to Cure | 10 days | Become current on payments |

| Indiana | Right to Cure | 20 days | Correct specified issue |

Other Required Notices

| State | Notice Type | Notice Window | Cure Requirement |

|---|---|---|---|

| Massachusetts | Default Notice | 21 days | Make payment |

| Rhode Island | Late Payment | Payment Due Date | Make payment |

These legally mandated notices detailing cure rights preceding seizures add obstacles for dealers and repo agents pressuring compromise or surrender from delinquent borrowers across involved states. Consult qualified legal counsel upon licensing to ensure full compliance.

Sources For this Article:

- https://repo.buzz/repossession-laws-by-state/

- https://www.abi.org/feed-item/can-the-repo-man-move-another-car-to-get-to-yours-in-pennsylvania

- https://www.avvo.com/legal-answers/can-a-repo-man-move-a-car-to-get-to-another-car–4842016.html

- https://www.answers.com/american-cars/Can_they_repo_your_car_if_you_move_to_another_city

Legal Disclaimer: This article provides general educational information about vehicle repossession guidelines and is not formal legal advice tailored for specific cases or jurisdictions. Vehicle asset seizure regulations differ across states and circumstance-specific complexities. Always consult a licensed attorney in your area after vehicle defaults to guarantee compliant actions respecting evolving consumer protections. We make no claims or guarantees related to following generalized recommendations herein. Seek qualified counsel regarding how statutes governing collateral reclamation directly impact dealership obligations uniquely across operational regions before attempting to exercise perceived seizure rights, whether mentioned explicitly or omitted. Our company accepts no liability from any party for decisions influenced by non-individualized advice within this content under any applicable laws.